Goldman Sachs commodity analysts take a look at the "risk developments" to their forecast for $86 oil by December 2023.

On net, the risk developments ... have been bullish-to-mixed over the past month

The bullish developments are:

- The arrival of inventory draws

- The key bullish risk—lower-for-longer OPEC+ supply—has grown with the fall in our Russia supply nowcast and Saudi's reiterated commitment to cuts and apparent willingness to extend and even deepen cuts.

- Recent Black Sea drone attacks highlight the risk to Russia commodity exports

In contrast, the other key bearish risk—a further rise in Iran supply—has grown

- risk has grown with media reports of a potential US-Iran prisoner swap, and a TankerTrackers estimate that Iran exports of crude and condensates during the first 20 days of August have surged by over 500kb/d to 2.2mb/d.

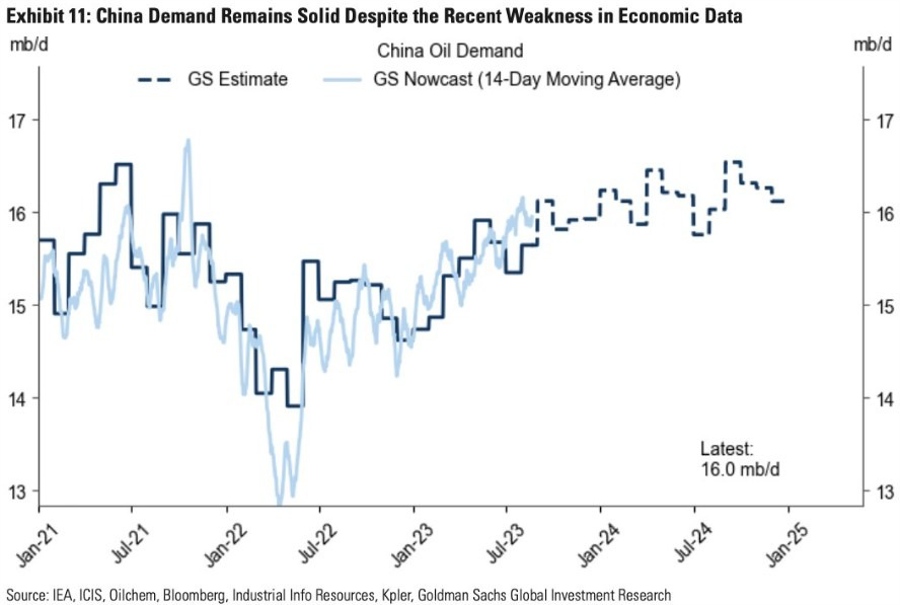

Finally, China demand news is mixed

- downside risk to our economists' 2023 GDP growth forecast of 5.4% has grown given the ongoing property slump and the inability of only marginal policy easing to restore confidence

- On the other hand, our China oil demand forecast has been solid this summer ...

- This disconnect likely reflects that the weakness in China macro data is quite concentrated outside the oil-intensive services sector, and that China international jet demand is still recovering.

On China: