Some remarks from Goldman Sachs outlook for China in 2023:

- We expect weak growth in Q4 and Q1 as the Zero Covid Policy (ZCP) likely stays in place during the winter.

- Although the leadership has clearly signaled that it aims to exit ZCP, we do not expect actual reopening to start until April. The basic reason for this is that medical and communication preparations will take time.

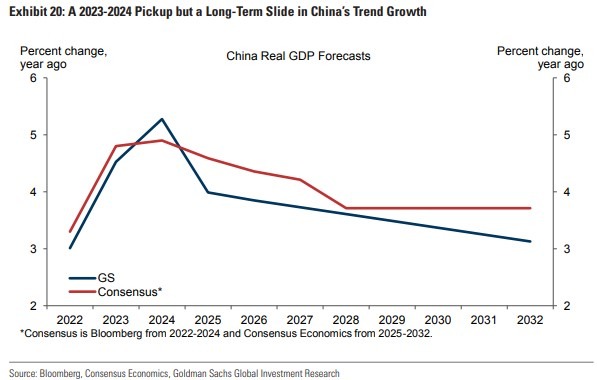

- we look for a meaningful reopening growth boost in H2, which will likely extend into 2024

- our Q3 and Q4 forecasts of 10% and 6% annualized

- we expect a continued drag from Covid caution as well as other headwinds, some cyclical and some more structural. On the cyclical side, fiscal policy is set to tighten if the domestic economy rebounds, and China’s pandemic-related export boom should fade as global demand for tech, housing, and Covid-related products slows further. On the structural side, we see the contraction of the property sector and US chip export restrictions as multi-year drags. We estimate that the ongoing slide of the property sector will subtract around -1½pp from growth next year as it continues to delever and face demographic headwinds