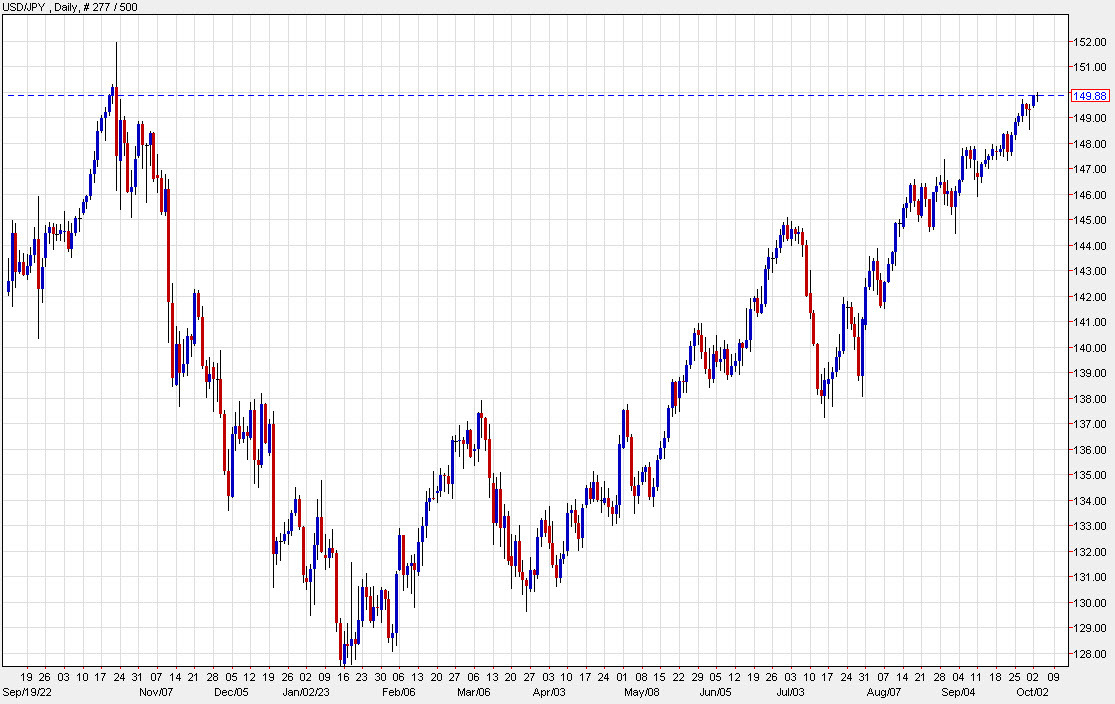

It's all hanging on a thread at the moment but Treasury yields have come off a tad with US 10s down to 4.71% from a high of 4.75%. That hasn't done much for USD/JPY, which is at 149.90 after a high of 149.98.

The question is: What happens if 150 breaks? It's possible that the Japanese MOF brings the hammer and that would kick off a wave of follow-on trades and stops that could cascade lower. I would think the dip would be bough in the 148.50 range because the fundamentals are still there for a higher USD/JPY.

Equally intriguing is -- what happens if 150.00 breaks and there is no intervention. I think that's what is going to happen because in non-USD terms, JPY isn't that weak. But no one knows and I could see the argument for intervention here, if only because the market will help you.

But if there is no intervention, you have to circle the next big round figure -- 155 -- which is the level Goldman Sachs has circled. I think it could get there in short order but the problem is that if a move happens too fast it could bring the MOF back into play. Remember that last October there was a spike to 151.94 before the sharp reversal so the playbook was to let the longs pile in on a break and then blow them out.