There are three elements to this week's gold rally:

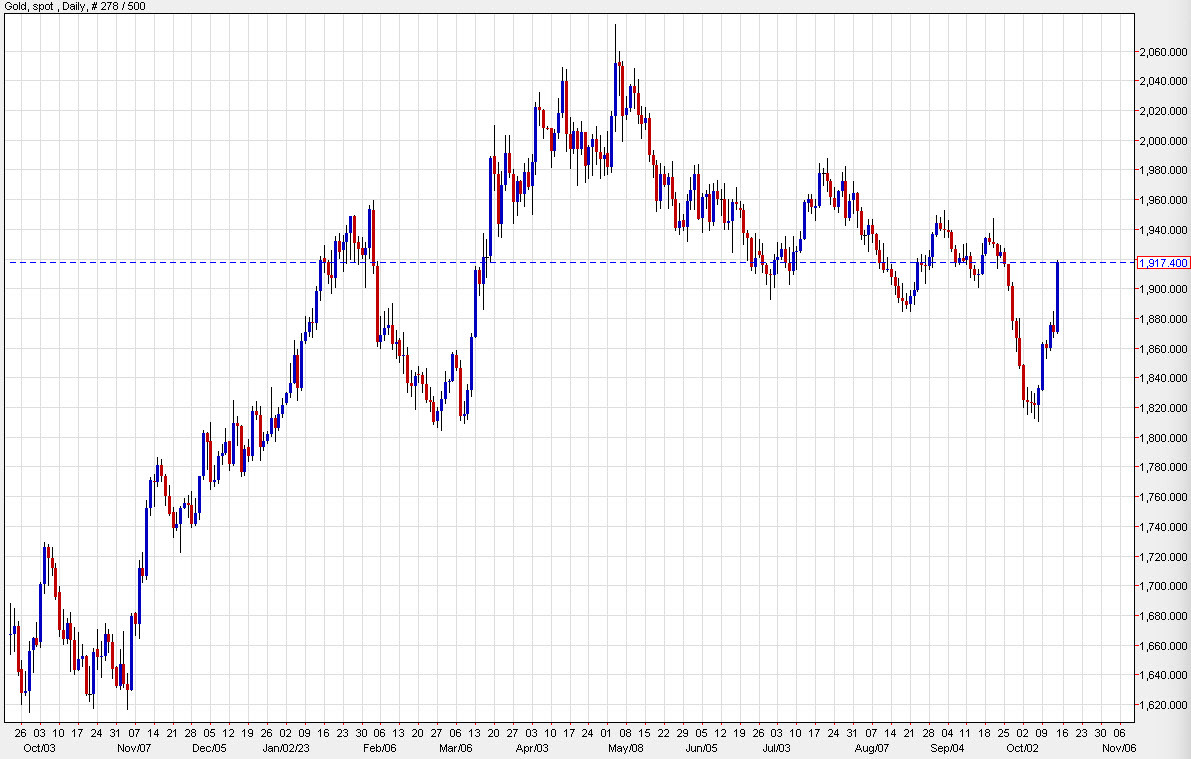

1) A bounce from technical support in the low $1800s.

In March, gold also bounced here, as the chart illustrates.

2) US dollar weakness and worries about US debt

This week's terrible slate of Treasury auctions were a small slice of evidence that deficits are a driver behind the recent rise in long-term Treasury yields. If that case continues to unfold, then the sky is the limit for gold.

3) War

The atrocities committed by Hamas have led to a brutal escalation and the fear is that it's not limited to Israel and Hamas. Signs point to an Israeli offensive this weekend and simultaneous bids in oil and gold today point to a potential escalation.

What makes it tough to buy gold here is that it's impossible to assign weights to each of those factors; they're guesses at best. Gold has risen $100 from the lows and I'd have to put a good chunk of today's $45 rally on war but it also comes with yields back down. In general, geopolitical gold trades need to be faded because WWIII never happens and the reality of war never matches the fear (at least for those of us who aren't in it) but if the rally is more about technicals and deficits, then I don't know if the risk/reward on fading this move is worth it.