The US labour market is strong, as evidenced by the upside surprise in the NFP last week:

Eyes now turn to inflation with:

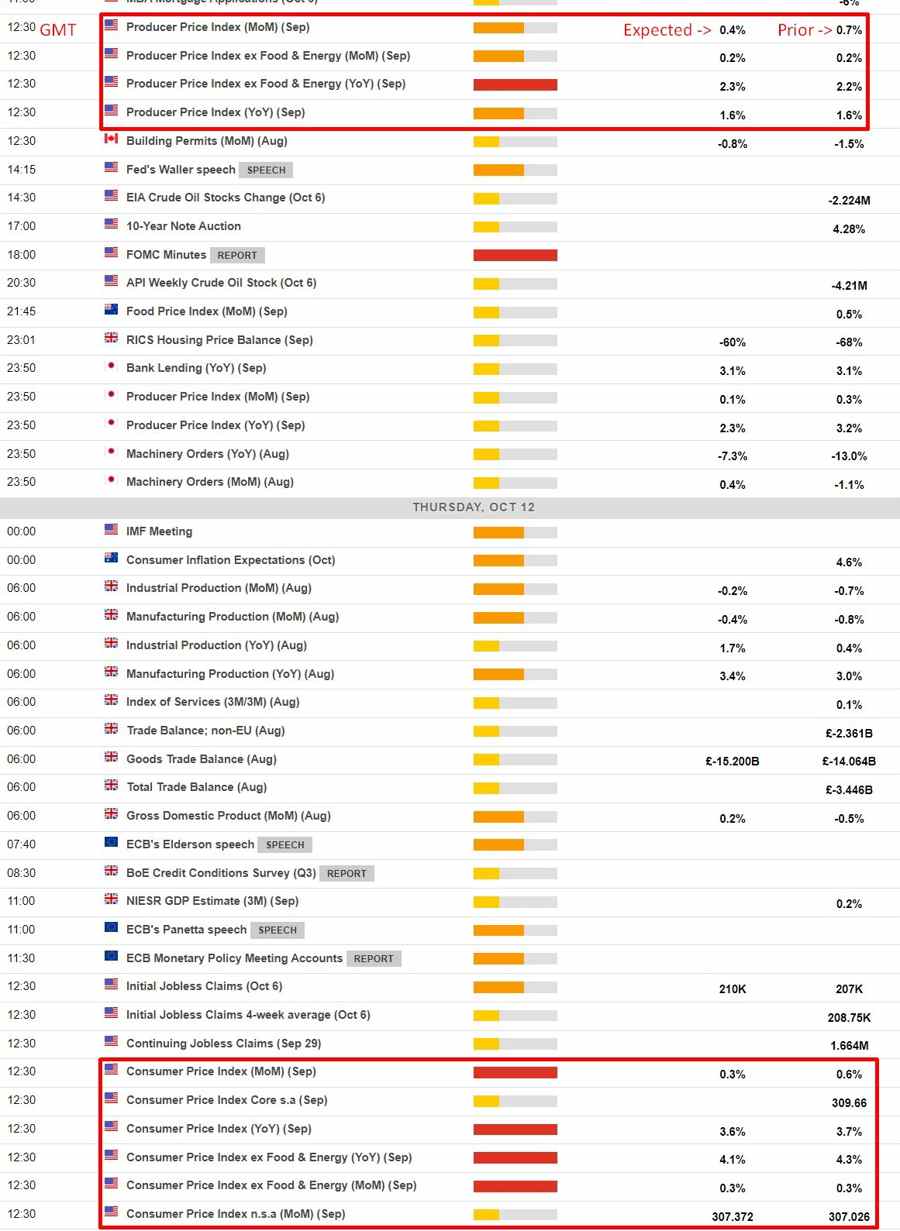

- September PPI due on Wednesday at 8.30am US Eastern time

- September CPI due on Thursday at 8.30am US Eastern time

There are also less direct indications due from:

- The September inflation expectations in the Atlanta Fed’s business inflation expectation report at 1000 US Eastern time on Wednesday

- The University of Michigan survey of consumers at 1000 US Eastern time on Friday.

Inflation data will shape the outlook for Federal Open Market Committee (FOMC) monetary policy:

- the recent move higher for energy costs are likely to have spilled into underlying inflation, but on the other hand other inflationary pressures may be easing.

- more evidence about the lagged effects of past rate hikes should be evident also

In-line or lower inflation figures will support the FOMC extending its pause in rate hikes after the October 31-November 1 meeting. And, of course, higher could see another hike this year, especially given the resiliency of the jobs market.

I'll be back tomorrow with a preview of the PPI, and then Thursday for the CPI.