- The advance reading was +0.5%

- Prior was +1.1% (revised to +1.0%)

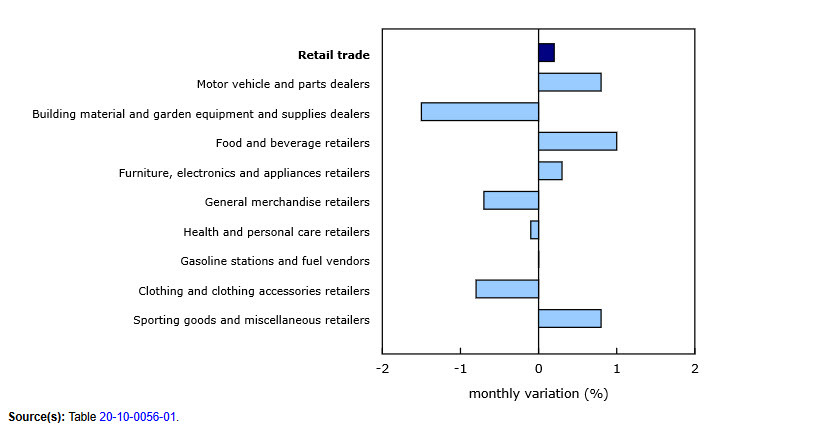

- Ex autos 0.0% vs +0.3% expected (prior was +1.3%, revised to +1.2%)

- June advance reading 0.0%

- Year-over-year sales +0.5% vs +1.4% prior

Coming into this report, core sales had risen for five consecutive months so a flat reading isn't a big red flag but higher interest rates are undoubtedly starting to bite.

Looking through the breakdown of the year-over-year changes, rather than month over month, there's a 6.9% rise in spending at supermarkets while there have been drops in furniture and building materials. That hints at how the squeeze on consumers has shifted spending towards essentials. It's at the margins though as spending on new/used cars is also higher while electronics and clothing have held up, at least before adjusting for inflation.