Microsoft will announce their earnings after the close today. So will Texas Instruments, Capital One, Navient, but safe to say the focus will be on the Microsoft numbers.

What are the some of the expectations?

- Earnings-per-share expected at $2.31

- Revenues of $50.9 billion

- intelligent cloud expected at $18.1 billion

- More personal computing $16.6 billion

- productivity and business processes $15.9 billion

The guidance for earnings and revenues:

- Earnings-per-share expected at $2.17 for Q2 and $9.20 to $9.47 for the year

- revenues $48.2 billion for Q2

- $196.8 billion for FY 2022 and 224.7B for FY 2023

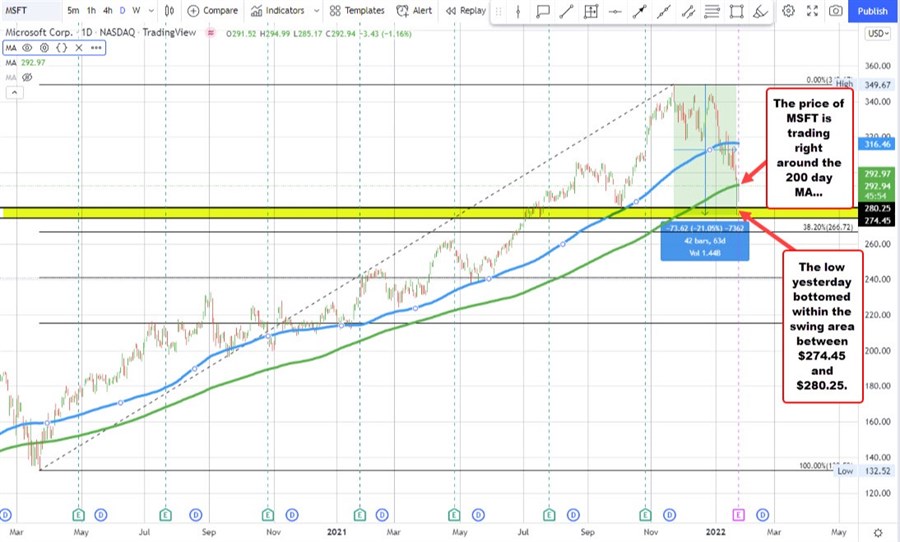

Looking at the daily chart below, the price moved up 163.86% from the pandemic low in April 2020. The last 43 bars (8-9 weeks), however, has seen the price move down some 21% from the high to the low reached yesterday. That low extended to $276.05. The current price is at $293.58. The low price yesterday stalled between swing lows from July and October between $274.45 and $280.25.

Moving below that level would next target the 38.2% retracement from the April 2020 low at $266.72. It would also have the stock price moving farther away from the key 200 day MA.

On the topside, the price yesterday had moved below its 200 day moving average for the first time since March/April 2020. That moving average comes in at $292.97. With the current price trading at $293.34, the price is just above that key MA level. Move higher and traders will start to eye the 100 day moving average at 316.46 as the next key upside target. That moving average is starting to turn to the downside.

Needless to say the earnings will tip the technical bias more to the downside - below the 200 day moving average - or more to the upside - above the 200 day moving average.

Tomorrow Boeing will release earnings before the open.

- Earnings-per-share are expected at $-0.42/$0.02 GAAP

- revenues are expected at $16.59 billion

- Guidance for Q1 2021 earnings are $0.36/$0.80 GAAP

- Revenue Q1 guidance expected at $18.63 billion