With the Bank of Canada hiking rates more aggressively, Canada's largest bank new sees a deeper correction in the nation's housing market.

They now project home resales to fall nearly 23% this year and 15% next year in Canada, and the national benchmark price to drop 12.4% from peak to trough by the second quarter of 2023.

A 12% drop would be larger than in any cycle over the past 40 years.

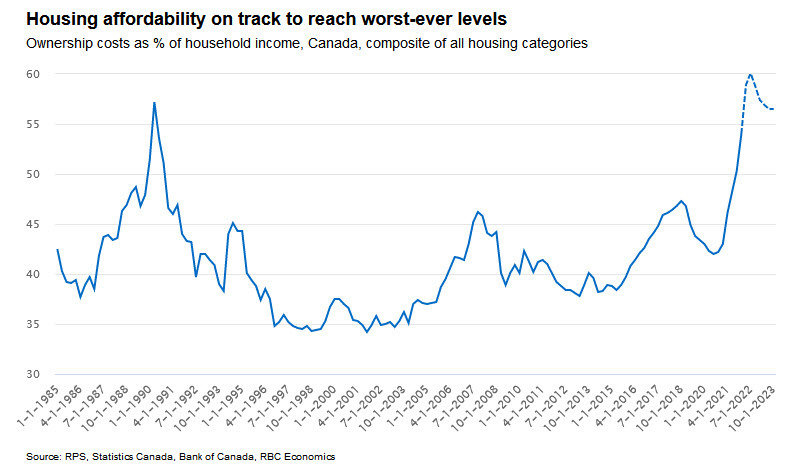

"Rising rates are squeezing housing affordability hard. By the time the Bank of Canada is done, RBC’s aggregate affordability measure could easily be at it worst-ever level nation-wide," they write.

Many are worried the decline could be even worse with Canada scoring some of the worst metrics globally for home prices and after a 50% rise during the pandemic. However RBC says it will be a correction, not a collapse.

"While a more severe or prolonged slump cannot be ruled out, we expect the correction to be over sometime in the first half of 2023—lasting approximately a year—with some markets likely stabilizing faster than others. Solid demographic fundamentals (including soaring immigration) and a low likelihood of overbuilding should keep the market from entering a death spiral," the write.

Of course, no matter what the set of facts, would you expect the country's biggest bank to forecast a housing collapse?