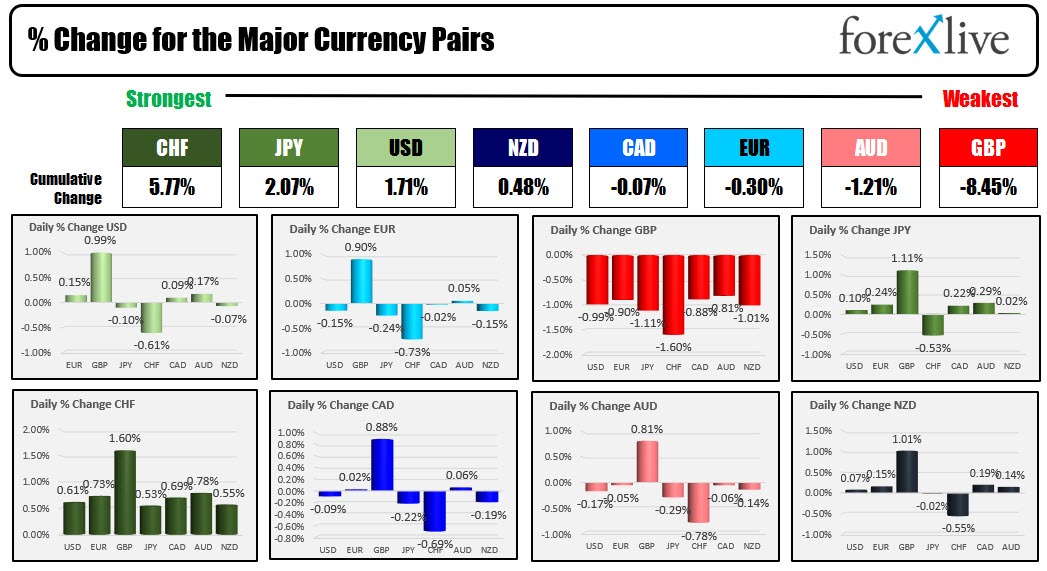

The CHF is the strongest as investors rush into the safety of it's currency. The GBP is the weakest after the BOE announced that they would buy bonds in an attempt to thwart the exodus from investors after the recently announced tax cuts and stimulus measures from the new government. The BOE also said they would delay the bond selling plan until September, and may raise rates as well to stem the pounds decline. The news has helped to reverse some of the dollar buying. The GBPUSD did spike higher to a level of 1.08378 after the announcement, but has since reversed back lower and traded to a new session low at 1.05374. The USDCHF has seen selling pressure as investors head into the relative safety of the CHF. The pair is testing its 100 hour moving average at 0.9861 in early North American trading. The USD is still mostly higher but is retracing most of the gains as it works back toward unchanged on the day (or closer to it).

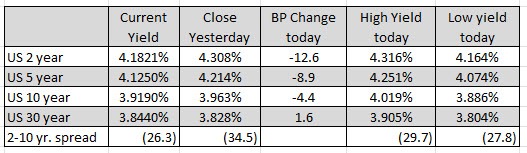

US stocks are lower in premarket trading but has clawed back most of its declines. US yields are also moving back to the downside after the 10 year yield moved to a new cycle high of 4.019%. It is currently trading at 3.907%.

A snapshot of the major markets near the start of the US session is showing.

- Spot gold is down $2.29 -0.14% $1626.35

- Spot silver is down $0.18 or 1.0% $18.16

- Crude oil is trading at $78.86 up $0.89 or 0.5%

- Bitcoin is trading at $19021

- Natural gas is down $0.11 -1.69% at 660 $0.08

In the pre-market for the US stocks, the major indices have rebounded after the Bank of England decision to buy bonds, but the major indices are still lower on the day after the mixed close yesterday (Dow and S&P were lower but the Nasdaq did rise).

- Dow is down -32 points after yesterdays -125.82 point decline

- S&P index is -14 points after yesterdays -7.77 point decline

- NASDAQ index is -90 points after yesterdays 26.58 point rise

In the European equity markets today, the major indices are higher:

- German DAX -1.08%

- France's CAC -1.1%

- UK's FTSE 100 -0.83%

- Spain's Ibex -1.44%

- Italy's FTSE MIB -1.59%

In the US debt market, the yield curve is steep and the bid with the lower end moving lower and the longer and staying steady:

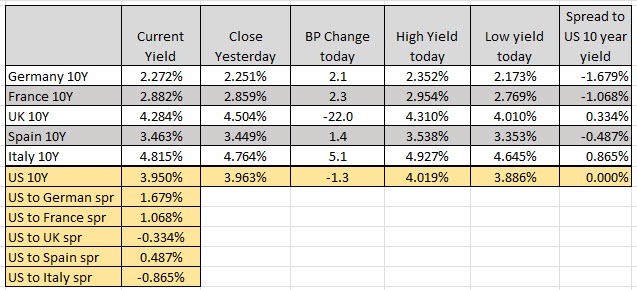

In the European debt market, the 10 year UK yield is down sharply after the intervention the bond market. The 10 year yield is down -22 basis points on the day.