- Services PMI 51.4 vs 51.0 expected and 50.8 prior.

- Manufacturing PMI 47.3 vs 48.2 expected and 48.0 prior.

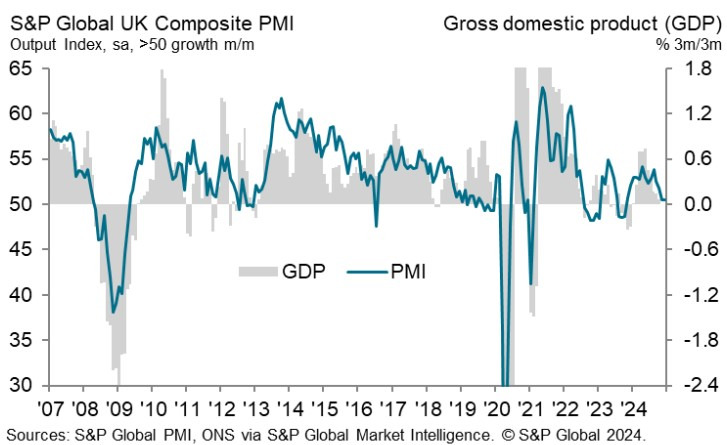

- Composite PMI 50.5 vs 50.7 expected and 50.5 prior.

Key Findings:

- Flash UK PMI Composite Output Index(1) : 50.5 (Nov: 50.5). Unchanged.

- Flash UK Services PMI Business Activity Index (2) : 51.4 (Nov: 50.4). 2-month high.

- Flash UK Manufacturing Output Index (3) : 45.7 (Nov: 48.3). 11-month low.

- Flash UK Manufacturing PMI (4) : 47.3 (Nov: 48.0). 11- month low.

Comment:

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

Businesses are reporting a triple whammy of gloomy news as 2024 comes to a close, with economic growth stalled, employment slumping and inflation back on the rise.

Economic growth momentum has been lost since the robust expansion seen earlier in the year, as businesses and households have responded negatively to the new Labour government’s downbeat rhetoric and policies. Business confidence has sunk to a two-year low as companies weigh up a tougher outlook for sales alongside rising costs, notably for staff as a result of changes announced in the Budget. The survey’s price gauges are indicating that inflation is turning higher again.

Firms are responding to the increase in National Insurance contributions and new regulations around staffing with a marked pull-back in hiring, causing employment to fall in December at the fastest rate since the global financial crisis in 2009 if the pandemic is excluded.

While the December PMI is indicative of the economy more or less stalled in the fourth quarter, the loss of confidence and increased culling of jobs hints at worse to come as we head into the new year. Policymakers at the Bank of England may be cautious about cutting interest rates, however, given the resurgence of inflation being signalled, adding further to downturn risks in 2025.”