- Services PMI 51.8 vs 52.4 expected and 52.4 prior.

- Manufacturing PMI 50.3 vs 51.4 expected and 51.5 prior.

- Composite PMI 51.7 vs 52.6 expected and 52.6 prior.

Key Findings:

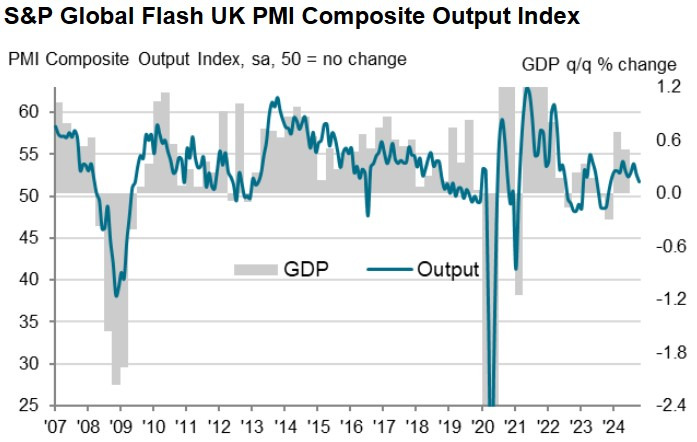

- Flash UK PMI Composite Output Index(1) at 51.7 (Sep: 52.6). 11-month low.

- Flash UK Services PMI Business Activity Index(2) at 51.8 (Sep: 52.4). 11-month low.

- Flash UK Manufacturing Output Index(3) at 50.9 (Sep: 53.6). 6-month low.

- Flash UK Manufacturing PMI(4) at 50.3 (Sep: 51.5). 6-month low.

Comment:

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“Business activity growth has slumped to its lowest for nearly a year in October as gloomy government rhetoric and uncertainty ahead of the Budget has dampened business confidence and spending. Companies await clarity on government policy, with conflicts in the Middle East and Ukraine, as well as the US elections, adding to the nervousness about the economic outlook.

The early PMI data are indicative of the economy growing at a meagre 0.1% quarterly rate in October, reflecting a broad-based slowing of business activity, spending and demand across both manufacturing and services. Worryingly, the deterioration in business confidence in the outlook has also prompted companies to reduce headcounts for the first time this year.

Cleary, the policies announced in the Budget have the potential to play a major role in steering the direction of the economy in the months ahead. Encouragingly, however, a further cooling of input cost inflation to the lowest for four years opens the door for the Bank of England to take a more aggressive stance towards lowering interest rates, should the current slowdown become more entrenched.”