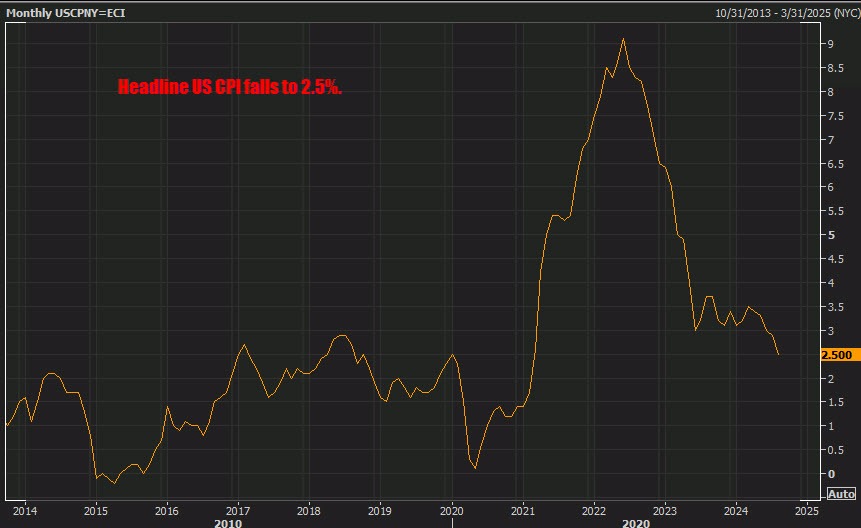

- Prior month 2.9%

- CPI YoY rose 2.5%. That was the smallest 12 month increase since February 2021.

- CPI MoM 0.2% versus 0.2% expected

- Month over Month unrounded 0.187%

Core measures:

- Core CPI YoY 3.2% vs 3.2% expected.

- Core CPI MoM 0.3% vs 0.2% expected

- Core unrounded 0.281%

- Real weekly earnings +0.5% versus -0.2% last month

- Shelter inflation rose by 0.5%

- Food increase by 0.1% after rising 0.2% in July

- The index for food away from home rose 0.3% for the month with food at home was unchanged

- energy prices fell -0.8% versus unchanged last month.

The energy index decreased 4.0 percent for the 12 months ending August. The food index increased 2.1 percent over the last year.

Summary of line items:

- Index for all items less food and energy rose 0.3% in August (up from 0.2% in July).

- Shelter index increased 0.5% in August; owners' equivalent rent rose 0.5%, rent index up 0.4%.

- Lodging away from home index rose 1.8% in August (up from 0.2% in July).

- Airline fares index increased 3.9% in August, reversing declines from the previous 5 months.

- Motor vehicle insurance index rose 0.6% in August; education and apparel indexes also increased.

- Used cars and trucks index fell 1.0% in August (following a 2.3% decrease in July).

- Household furnishings and operations index decreased 0.3% in August.

- Medical care index fell 0.1% in August (after a 0.2% decline in July).

- Communication, recreation, and personal care indexes each decreased 0.1% in August.

- New vehicles index remained unchanged in August.

- Over the past 12 months, the index for all items less food and energy rose 3.2%.

- Shelter index increased 5.2% over the last year, contributing over 70% to the total 12-month increase for items less food and energy.

- Notable 12-month increases: motor vehicle insurance (+16.5%), medical care (+3.0%), recreation (+1.6%), and education (+3.1%).

For the full report CLICK HERE.

Fed expectations after the release :

- 30 basis point cuts versus 32 prior to the release

- 108 basis points of cuts between now and the end of the year versus 114 prior to the report

- 15% chance of a 50 basis point cut in September down from 29% prior to the report

Looking at US stocks, the futures are implying:

- Dow industrial average -220 points

- S&P index -21.7 points

- NASDAQ index -60 points

Yields in the US are higher:

- 2-year yield 3.683%, +7.4 basis points

- 5- year yield 3.486%, +6.10 basis points

- 10 year yield 3.683%, +3.9 based

- 30 year yield 3.91%, +2.6 basis points

The USD has moved higher.