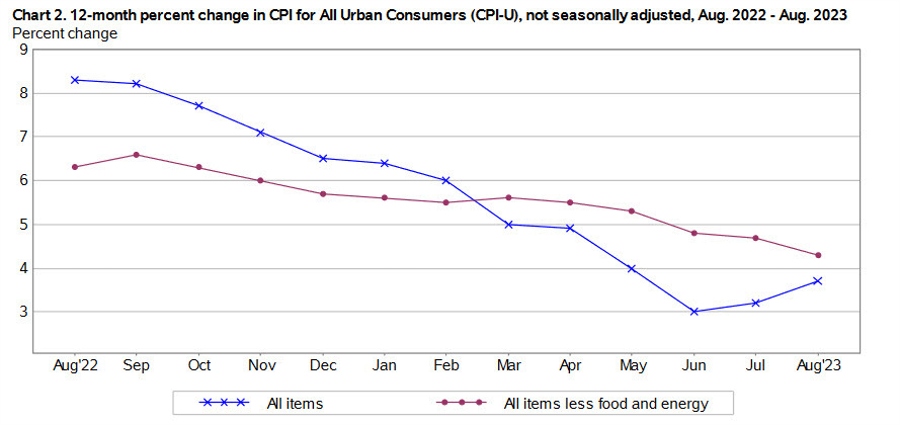

A response to Wednesday's US CPI report, the headline was unremarkable but the core rate jumped to a faster rise than was expected (there's a but on this, I'll come to that in a moment). ICYMI:

- Core CPI m/m +0.3% versus +0.2% expected. Last month 0.2%

- Forexlive Americas FX news wrap: US inflation runs a touch on the hot side

As for the 'but' on that +0.3% m/m core results, in their response piece Bank of Montreal point out that:

- on an unrounded basis the print was 0.278% m/m. This brought the YoY pace to its lowest level since September 2021 at 4.3% from 4.7% - matching forecasts.

Bolding is mine. Yes, hotter than expected but not by as much as the +0.3% would suggest.

BoM go on to note that the strength in the ex-shelter & rent measures. And :

- the 0.278% MoM core print was close enough to what the market was looking for that the data represents more of the passing of an event risk rather than a macro game changer.

- The Fed won't be hiking next week, but ... November is still very much a "live" rate decision.