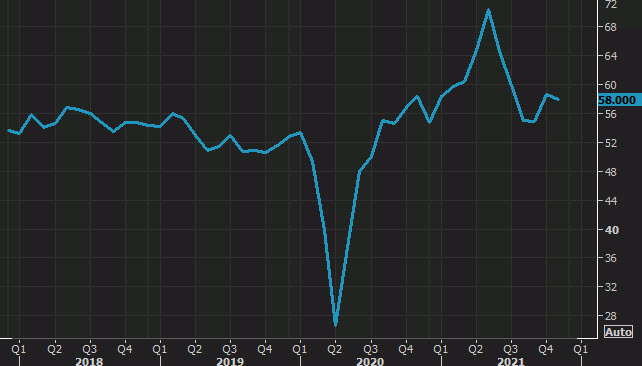

- Prelim was 57.5

- November was 58.0

- Service providers recorded the steepest increase in input prices on record (since October 2009)

- "The series-record rise in cost burdens was commonly attributed to greater transportation and distribution fees. That said, many firms stated that upward pressure on expenses from higher wage bills was a key factor, as companies sought to retain current staff and encourage new workers."

- Year-ahead outlook was the highest since November 2020

- Composite index 57.0 vs 56.9 prelim and 57.2 prior

Commenting on the latest survey results, Siân Jones, Senior Economist at IHS Markit, said:

“Service sector business activity growth remained strong in December, supporting indications of a solid uptick in economic growth at the end of 2021. Although the expansion in output softened slightly, the flow of new orders picked up, with buoyant client demand rising at the fastest pace for five months.

"The service sector continued to aid overall growth, as the manufacturing sector saw output hampered again by material and labor shortages. The impact of the latter, however, had a burgeoning effect on service providers as job creation rose at only a marginal pace amid challenges keeping hold of staff and enticing new starters.

"Subsequently, soaring wage bills and increased transportation fees drove the rate of cost inflation up to a fresh series high. "Business confidence strengthened at the end of the year to the highest since November 2020, as firms were hopeful of more favorable labor market and supply-chain conditions going into 2022. The swift spread of the Omicron variant does lace new downside risks into the economic outlook heading into 2022, however. Any additional headwinds or disruption faced by firms are likely to temper sentiment."