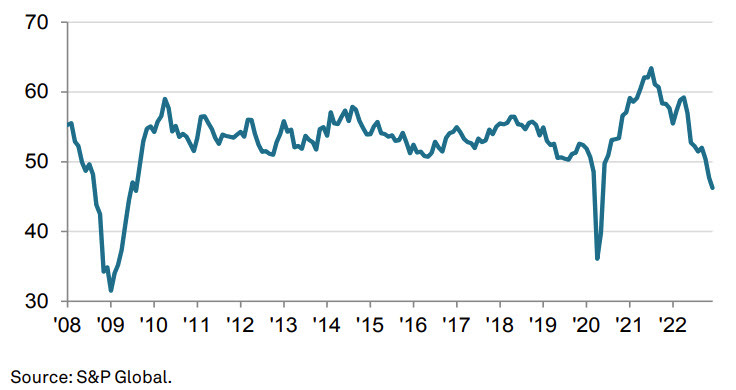

- Prelim 46.2

- Prior 47.7

- Lowest since May 2020

- Firms hiked their selling prices at the softest pace for just over two years

- Lower prices for some inputs such as metals and fuel led to the slowest uptick in cost burdens since July 2020

- The decrease in new orders was steep overall and among the fastest on record (since May 2007).

The manufacturing ISM index is due on Wednesday.

Siân Jones, Senior Economist at S&P Global Market Intelligence, said:

“The manufacturing sector posted a weak performance as 2022 was brought to a close, as output and new orders contracted at sharper rates. Demand for goods dwindled as domestic orders and export sales dropped. Muted demand conditions also led to downward adjustments of stock holdings, as excess inventories built earlier in the year were depleted in lieu of further spending on inputs. With the exception of the initial pandemic period, stocks of purchases fell at the steepest rate since 2009.

"Concerns regarding the outlook for demand weighed on hiring decisions. Job creation was only slight, and largely linked to skilled hires, as firms displayed caution.

"Sinking demand for inputs and greater availability of materials at suppliers led to a further easing of inflationary pressures. In fact, the rate of input price inflation fell below the series trend. Selling price hikes also eased, albeit still rising steeply. Slower upticks in inflation signal the impact of Fed policy on prices, but growing uncertainty and tumbling demand suggest challenges for manufacturers will roll over into the new year."