A slightly-hot producer price index reading has caused an outsized reaction in the FX and fixed income markets.

PPI was at +0.3% m/m compared to +0.2% expected but you wouldn't know it was only a small miss from the market reaction. US 10-year yields have jumped to 4.15% from 4.10% and the dollar is broadly stronger.

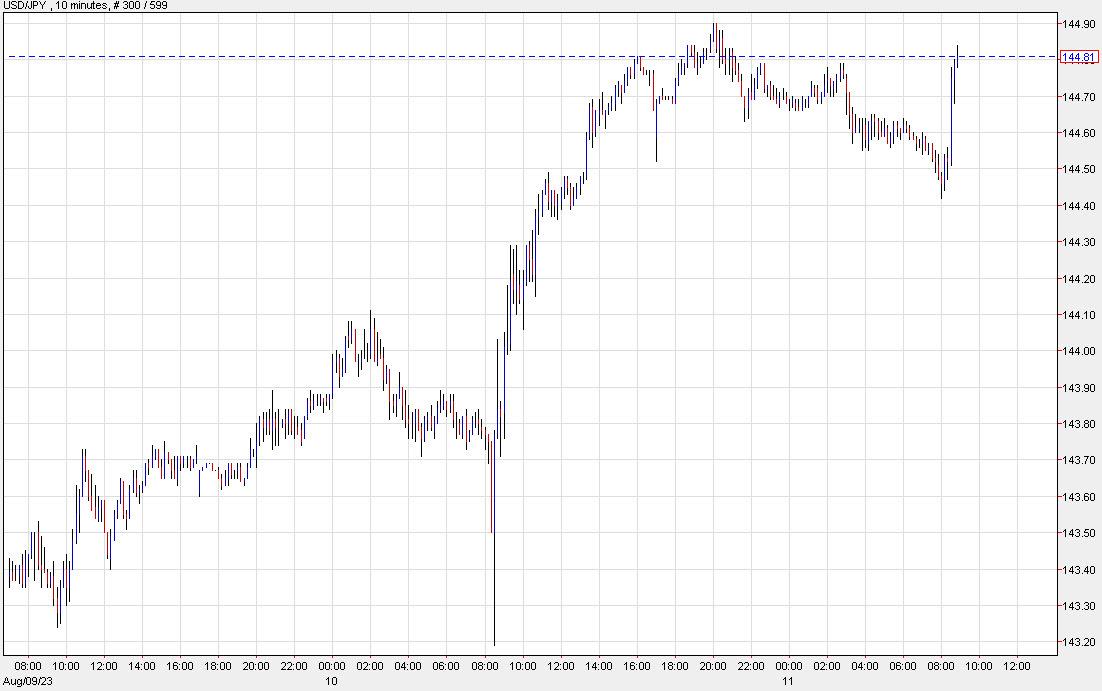

USD/JPY is having another look at 145.00 with the pair up to 144.82 from 144.50 before the release.

These moves are way out of line from where I stand, especially when the PPI reading was driven by things like food, warehousing and transportation services.

At the same time, I wonder if this is revealing the underlying bias in the market rather than causing it. Yesterday we had a cool CPI reading and yields rose anyway. Maybe Ackman is onto something.