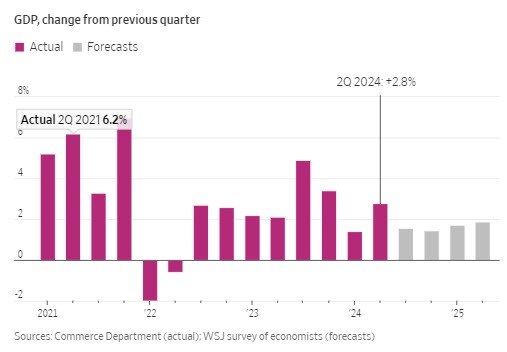

- Prior quarter (Q1) 1.4%. In the Q42023., growth rose by 3.4%

- GDP Q2 2.8 % vs 2.0% estimate. The Atlanta Fed GDPNow estimate was at 2.6%

- GDP sales 2.0% versus 1.9% estimate. Prior 2.0%

- GDP consumer spending 2.3% vs 1.5% prior

- GDP deflator 2.3% versus 2.6% estimate. Prior 3.1%

- GDP core PCE prices 2.9% versus 2.7% estimate. Prior 3.7%

- PCE prices advanced 2.6% vs 3.4% prior.

- PCE ex food and energy and housing 2.5% vs 3.3% prior

- PCE services ex Energy and housing 3.3% vs 5.1% prior

- inventories jumped 6.9% adding 0.8% to the quarterly GDP data

- business investment rose by 5.2% clip as companies invest in equipment (think chips)

Primarily consumer spending from increases in services and goods (up 2.3%). Also inventory increased this month (last quarter the inventories subtracted from GDP). The change in inventory added 0.8% vs a decline of -0.4% last quarter

The decline in the PCE measures is good news for inflation, although the core PCE was higher than expectations at 2.9% versus 2.7%, it was down sharply from 3.7%. The headline PCE tumbled from 3.4% to 2.6%.

Contributors and subtrators to the 2.8% growth:

- Consumption, +1.57% (last quarter +0.98%)

- investment, +1.46% (last quarter +0.77%)

- Government, +0.53% (last quarter +0.31)

- Net International Trade -0.72% (last quarter -0.65%)

Within the investment, inventories added 0.82% (vs -0.65% last quarter).

If you took out the inventory swing this month, growth was around 2%. If you took out the swing from inventories last month, the 1.4% becomes around 2.0%. That is trend growth.

The end-of-year Fed projections shows -69 basis points versus 72 basis points prior to the releases of GDP and durable goods

Stock futures are implying (but volatile):

- Dow up 60 points

- S&P up 3 points

- NASDAQ index down -4.3 points

the US debt market, yield still remain lower:

- 2 year yield 4.399%, -1.6 basis points.

- 5-year yield 4.118%, -3.3 basis points

- 10 year yield 4.236%, -4.9 basis points

- 30-year yield 4.493%, -5.5 basis points

The USDJPY has moved higher after continued declines took the pair toward a swing level near 151.93. The low reached 152.08.

NOTE: The Atlanta Fed GDPNow estimate forecasts 2.6%.

NOTE 2: It is likely that the inventory and trade data from yesterday was not included in the calculation. That might have been a small negative to the GDP.

NOTE 3: This is the first cut in what will be a series of estimates over the next few months.