- Prior was +5.5%

- m/m CPI 0.4% vs +0.0% expected

- Prior m/m reading was +0.1% (it was revised in the benchmark revisions from -0.1%)

- Real weekly earnings +0.7% vs +0.1% prior (revised to 0.0%)

Core inflation:

- Ex food and energy +5.6% vs +5.5% y/y expected

- Prior ex food and energy +5.7%

- Core m/m +0.4% vs +0.4% exp

- Prior core m/m +0.4%

This is on the hot side but not a complete shock with some economists flagging upside risks. The kneejerk reaction was risk-off and US dollar strength but that didn't even last a minute and then revered. It looks as though all the talk of a hot number had everyone leaning in the same direction.

Used cards fell 1.9% while new vehicles rose 0.2%. Shelter and medical care both rose 0.7% m/m and transportation services rose 0.9%. Food rose 0.5% and energy climbed 2.0% with natural gas as a big boost, up 6.7%.

Housing has flattened out and rent is declining while gasoline prices are steady and natural gas has cratered. So there's disinflation in the pipeline. Will that be enough to get inflation back to 2% or will it get stuck at 3-4%? One warning sign is the 0.7% m/m rise in real weekly earnings, it could keep spending high.

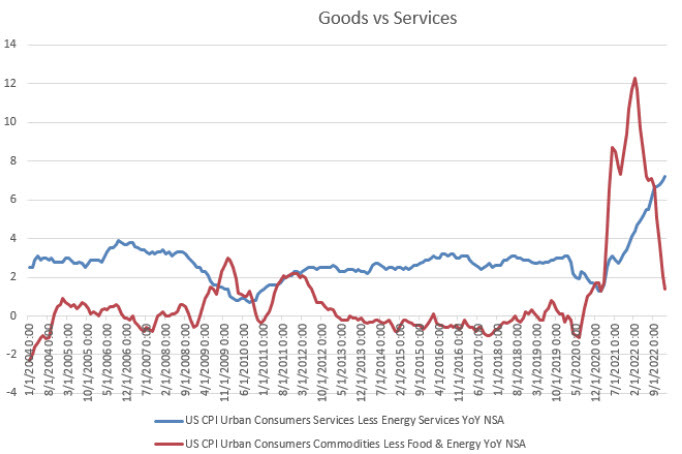

Here is a good chart from John Authers showing that goods inflation is now back below 2% but services inflation continues to accelerate. Some of that is the lag from housing and will come out, but will it be enough? And will goods inflation stay low?