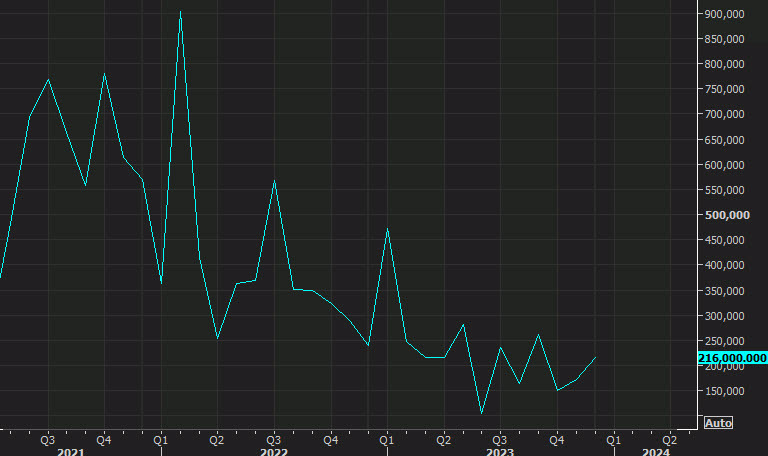

- Prior +216K (revised to +333K)

- November revised to +173K from +164K

- Two-month net revision +126K vs -71K prior

- Unemployment rate 3.7% vs 3.8% expected

- Prior unemployment rate 3.7%

- Participation rate 62.5% vs 62.5% prior

- U6 underemployment rate 7.2% vs 7.1% prior

- Average hourly earnings +0.6% m/m vs +0.3% expected

- Average hourly earnings +4.5% y/y vs +4.1% expected

- Average weekly hours 34.1 vs 34.3 expected

- Change in private payrolls +317K vs +164K expected

- Change in manufacturing payrolls +23K vs +5K expected

- Household survey -31K vs -683K prior

- Birth-death adjustment -121K vs -52K prior

USD/JPY was trading at 146.67 ahead of the data and the market was pricing in 142 bps in cuts by year end and a 34% chance in March of a cut.

This is undoubtedly hawkish and USD/JPY is up to 147.54 immediately with March down to 21% and 127 bps on the year.

This report is reminiscent of last January's report where there was also a huge beat. There are big seasonal adjustments in January and I think the BLS is struggling with that, something I wrote about at the start of the week.

Interestingly, the household survey shows a second consecutive drop in the number of employed people and exactly zero jobs growth in the past year, rising unemployment and more people who are looking for a job.

What worries me here -- and will worry the Fed -- is the wage growth. it accelerated at a sharp clip. Again, that could be due to seasonal adjustments as well because wages usually reset higher in the new year. That should be adjusted for but it could be hard for the BLS because of pandemic effects.