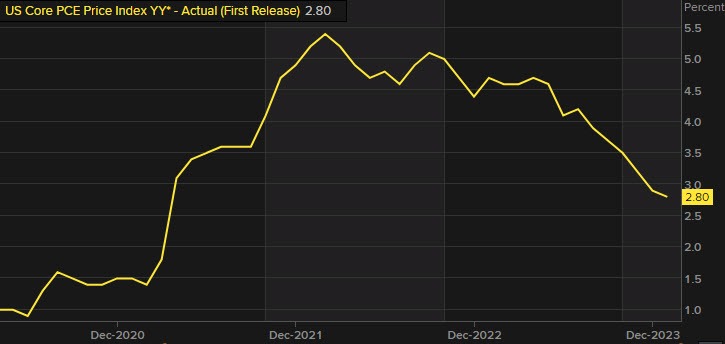

Core PCE

- Prior month 2.9%

- PCE Core 2.8% vs 2.8% expected. Last month 2.9%

- PCE core MoM 0.4% vs 0.4% expected

- Prior MoM core 0.2% revised to +0.1%

- Headline PCE 2.4% vs 2.4% expected (prior 2.6%). MOM 0.3% vs 0.3% expected

- Full report click here

3 month annualized 2.8%. 6 month annualized 2.6%.

Pre-Covid 2020, it was 1.5% for comparison.

Consumer spending and consumer income for January:

- Personal income 1.0% versus 0.4%. Prior month 0.3%.

- Personal spending 0.2% versus 0.2% expected. Prior month 0.7%

- Real personal spending -0.1% vs 0.6% last month revised from 0.5%).

1 minute prior to the report:

- Markets were pricing 78 bps of cuts in 2024.

- 2- year yield was at 4.689%.

- 10 year yield was at 4.311%.

- S&P index or implying a decline of -16.01 points.

- NASDAQ index was implying a decline of -46.75 points.

After the report:

- 2-year yield 4.666%

- 10 year yield 4.285%

- S&P index +12.0 points

- NASDAQ +76.5 points

The PCE data is largely as expected. Yields are lower/stocks are higher. The US dollar moved lower but has retraced some of those declines. Personal income grew nicely by 1.0%. Spending was moderate.

Continuing claims showed some weakness with a rise to 1.905M from 1.860M last week.