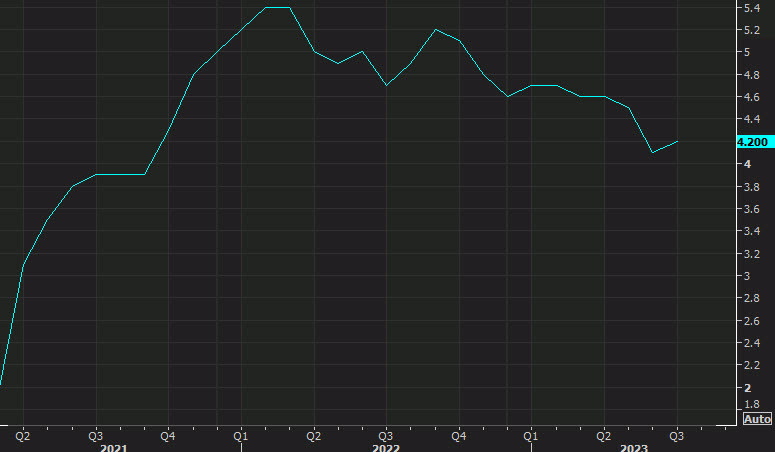

US PCE core

- Prior was +4.1%

- PCE core +0.2% m/m vs +0.2% expected

- Prior MoM +0.2%

- Headline inflation PCE +3.3% y/y vs +3.3% expected (Prior +3.0%)

- Deflator +0.2% m/m vs +0.2% expected (prior was +0.2%)

Consumer spending and income for July:

- Personal income +0.2% vs +0.3% expected. Prior month +0.3%

- Personal spending +0.8% vs +0.7% expected. Prior month +0.5%

- Real personal spending +0.6% vs 0.4% prior

These numbers are solid, all around. Inflation was in line with wage numbers cooling and spending staying strong. These are 'soft landing' numbers, if not 'no landing' but that's how a slowdown always starts. Bonds have a bit of a bid after the data, which might reflect falling angst about inflation. The headline ticked up and will tick up again in August on energy prices.