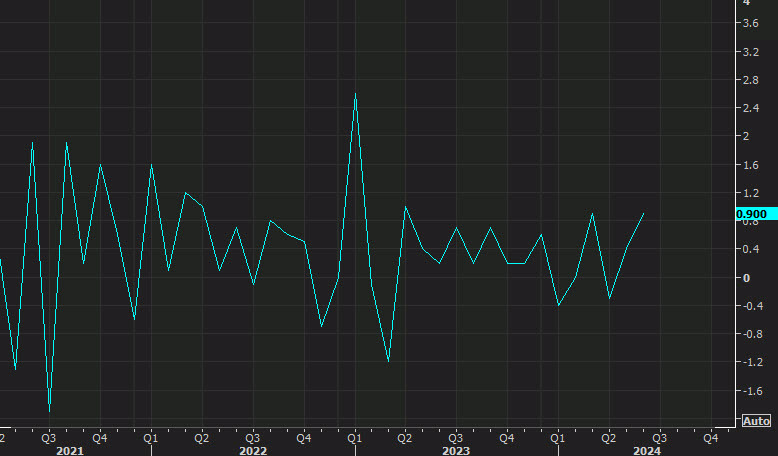

- Prior month: 0.0% (revised to -0.2%)

- Retail sales came in at $709.7 billion vs $704.3 billion in the month before

Details:

- Retail sales: +1.0 vs 0.0% prior

- Retail sales YoY: +2.7 vs +2.3% prior

- Ex Autos: +0.4 vs 0.4% prior (estimate was +0.1%)

- Prior ex autos: +0.4% (revised to +0.5%)

- Control group: +0.3 vs 0.9% prior (estimate was 0.1%)

- Prior month control group: 0.9%

- Ex autos and gas: +0.4vs 0.8% prior

These are good numbers.

Perhaps equally as important as this report: The CEO says "so far we are not experiencing a weaker consumer overall around the world," including in early August.

In terms of components:

- Motor vehicle & parts dealers: Up 3.6% This is a significant monthly increase, possibly indicating renewed consumer interest in vehicle purchases.

- Electronics & appliance stores: Up 1.6% Showing resilient consumer demand for tech and appliances.

- Building material & garden equipment & supplies dealers: Up 0.9% m/m in a surprise sign of strength despite warnings from Home Depot and others

- Food & beverage stores: Up 0.9% Indicates steady spending at grocery stores

- Food services & drinking places: Up 0.3% Showing continued, albeit modest, growth in dining out. This is a spot to watch.

- Health & personal care stores: Up 0.8% Showing consistent growth in this sector.