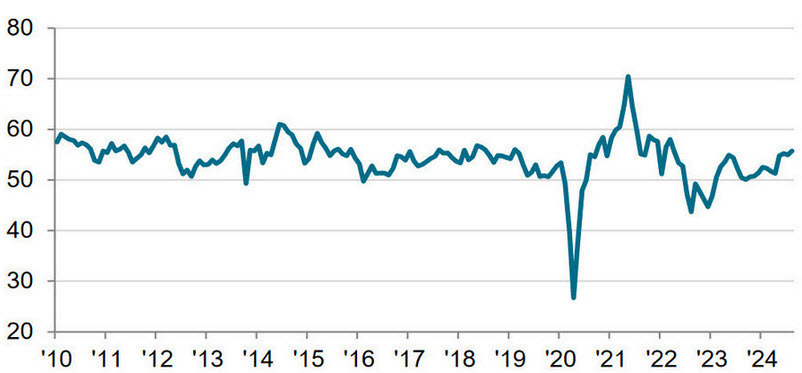

- Final Sept reading was 55.2

- Manufacturing 47.8 vs 47.5 expected

- Prior manufacturing was 47.3 prior

- Composite 54.3 vs 54.0 prior

These numbers are a touch hot, highlighting once again that the US economy is fine.

Commenting on the data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“October saw business activity continue to grow at an encouragingly solid pace, sustaining the economic upturn that has been recorded in the year to date into the fourth quarter. The October flash PMI is consistent with GDP growing at an annualized rate of around 2.5%.

“Demand has also strengthened, as signalled by new order inflows hitting the highest for nearly one-and-a-half years, albeit with both output and sales growth limited to the services economy.

“Sales are being stimulated in part by more competitive pricing, which has in turn helped drive selling price inflation for goods and services down to the lowest since the initial pandemic slump in early 2020. These weaker price pressures are consistent with inflation running below the Fed’s 2% target.

“Businesses nevertheless remain cautious about hiring, leading to a third month of modest payroll reductions. Firms are worried in particular about uncertainty caused by the Presidential Election.

“More encouragingly, confidence in the longer, year- ahead, outlook has improved as companies hope that a stabler post-election environment is more conducive to growth. This is especially so in the manufacturing sector, where factories hope that the current soft patch in production and sales will reverse as the uncertainty caused by the political environment passes.”

This is a dream scenario with new orders jumping and inflation running below 2% with confidence picking up.