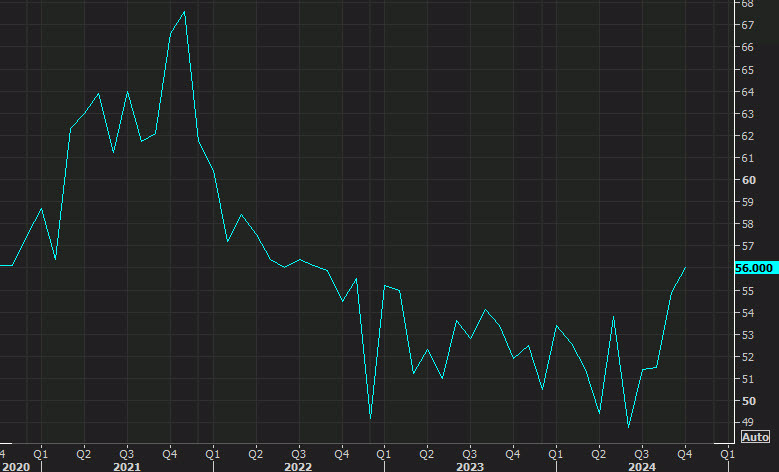

ISM services

- Best since Sept 2023

- Prior was 54.9

- Business activity index 57.2 vs 59.9 prior

- Employment 53.0 vs 48.1 prior

- New orders 57.4 vs 59.4 prior

- Prices paid 58.1 vs 59.4 prior

- Supplier deliveries 56.4 vs 52.1 prior

- Inventories 57.2 vs 58.1 prior

- Backlog of orders 47.7 vs 48.3 prior

- New export orders 51.7 vs 56.7 prior

- Imports 50.2 vs 52.7 prior

- Inventory sentiment 53.0 vs 54.0 prior

- Full report

This is a goldilocks number with prices paid improving (though still well-above 50). Fed pricing for this week is still showing a done deal but December is at 80% and the odds of three cuts by the end of January are down to 29%.

Comments in the report:

- “Material availability and delivery continues to improve. The port strike had an impact, as we had to divert shipments, but the overall costs are not material. Services cost remains elevated but easier to negotiate.” [Accommodation & Food Services]

- “Monitoring inventories much closer than in the past. We’re refilling inventories for the fall and winter seasons are lower level than normal, but those decisions are easy to understand.” [Agriculture, Forestry, Fishing & Hunting]

- “Business is good. Building backlog. Commercial Construction is strong. Commercial Service is busy. All other areas are level.” [Construction]

- “Hurricane Helene seriously damaged an IV production plant in North Carolina, which was 60 percent of all national supply of IV bag fluid/solution. We are now starting to experience shortages. In addition, two hurricanes hit Florida, which impacted many of our lab vendors. Plus, the port workers’ strike impacts shipments of materials that our (U.S.) labs use to manufacture medicine and medical supplies. We anticipate a rise in prices and longer wait times, and most likely, shortages of some supplies.” [Health Care & Social Assistance]

- “Sadly, the recent hurricanes/tornadoes, and any future climate-related catastrophes, are good for the equipment sales and rental businesses. That and the continued infrastructure spending.” [Information]

- “Revenue cycles are lengthening. Good sales, but longer service periods. Commodity pricing is stabilizing as inflation concerns ease. Business is in a steady state, with everyone holding an even keel awaiting U.S. election results.” [Professional, Scientific & Technical Services]

- “Hurricane impacts have affected supplier deliveries.” [Real Estate, Rental & Leasing]

- “Port strikes did not impact our supply chain, but we confirmed all our strategic vendors had plans in place should they have an impact.” [Retail Trade]

- “Business is booming, nothing slowing down. Prices continue to increase slightly.” [Utilities]

- “The economy is still causing issues within our business and that of our suppliers.” [Wholesale Trade]