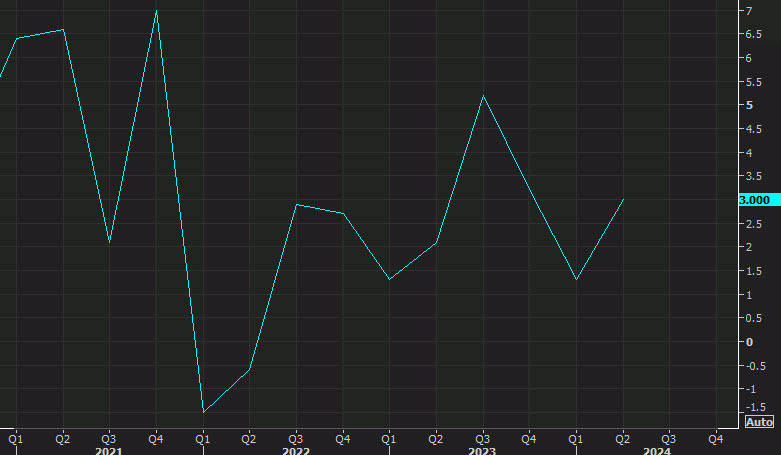

- Advance Q2 reading was +2.8% annualized

- Final Q1 reading was +1.4% annualized

Details:

- Consumer spending +2.9% vs +2.0% advance

- Consumer spending on durables +4.9%

- GDP final sales 2.2% vs +2.0% advance

- GDP deflator +2.5% vs +2.3% advance

- Core PCE +2.8% vs +2.9% advance

- Business investment +4.6% vs +5.2% advance

- PCE services inflation excluding energy and housing 2.3% vs 3.3% advance

- Corporate profits prelim +1.7% vs -2.7% prior

Contributors and subtrators to the 3.0% growth:

- Consumption: +1.95% (vs +1.57% advance, last quarter +0.98%)

- Government: +0.46% (vs +0.53% advance, last quarter +0.31%)

- Net International Trade: -0.77% (vs -0.72% advance, last quarter -0.65%)

- Inventories: +0.78% (vs +0.82% advance, last quarter -0.42%)

Q2 is in the rear-view mirror now but this shows that the economy was as strong as many of the companies reporting earnings said. Looking ahead, tomorrow we get PCE numbers and it could skew the prior number (tomorrow is July numbers, these revisions presumably reflect June). How that flows through could ultimately be dovish as a higher base might put downward pressure on the July number, though it wouldn't change the y/y numbers.

Net-net, this report is undoubtedly bullish for the dollar. GDP was higher and consumer spending was stronger. It's hard to imagine a 50 bps cut with this data (and initial jobless claims), even with a soft non-farm payrolls report.