- Prior was -0.2%

- Six-month decline accelerates to 2.6%, worse than previous 2.2% fall

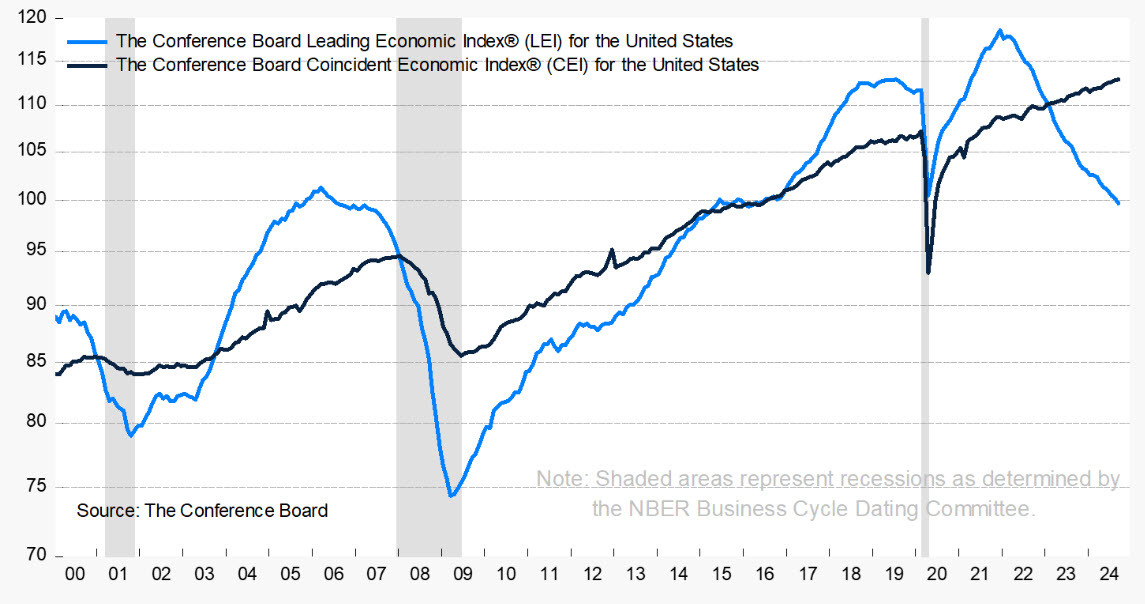

This index isn't a market mover but it's a decent 10,000 ft view on the economy and shows why the Fed is in an easing cycle.

“Weakness in factory new orders continued to be a major drag on the US LEI in September as the global manufacturing slump persists,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “Additionally, the yield curve remained inverted, building permits declined, and consumers’ outlook for future business conditions was tepid. Gains among other LEI components were not significant enough to offset weakness among the four gauges mentioned above. Overall, the LEI continued to signal uncertainty for economic activity ahead and is consistent with The Conference Board expectation for moderate growth at the close of 2024 and into early 2025.“