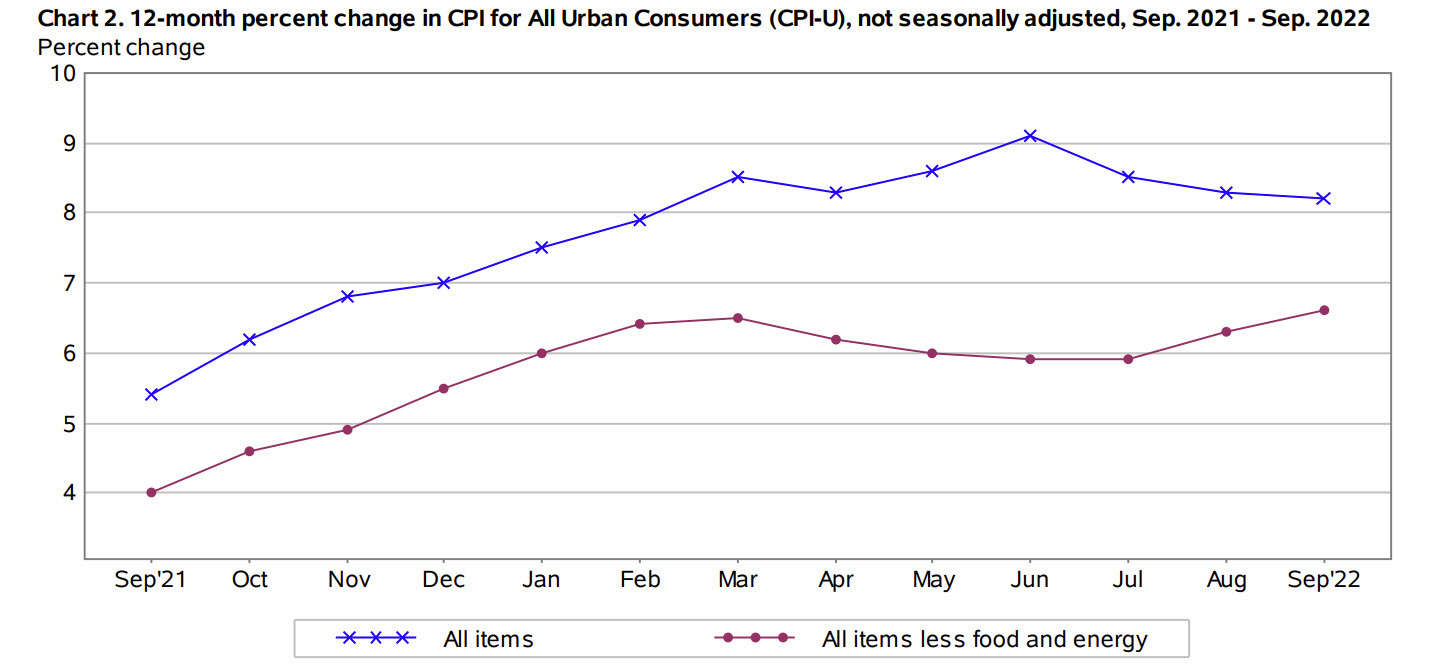

Note the re-acceleration of core

- Prior was +8.5%

- +0.4% m/m vs +0.2% expected and 0.1% prior

Core CPI:

- +6.5% y/y vs 6.5% expected and 6.3% prior

- +0.6% m/m vs +0.5% expected and +0.6% prior

The Fed funds futures market was pricing in a terminal top at 4.65% in March just ahead of the data and that's up to 4.84%. The market is now pricing in an 13% chance of 100 bps on Nov 2. There have been some huge moves in markets on these numbers with the dollar soaring. S&P 500 futures went from +40 to -60.

- Real weekly earnings -0.1% vs -0.1% m/m prior (revised to +0.2%)

- CPI energy -2.1% vs -5.0% prior

- Gasoline -4.9% m/m vs -10.6% prior

- New vehicles +0.7% vs +0.8% prior

- Used vehicles -1.1% vs -0.1% m/m prior

- Owners' equivalent rent +0.8% m/m vs +0.7% prior

- Food +0.8% vs +0.8% prior

- Full release (pdf)

USD/JPY is up to a fresh cycle high at 147.33 and that has all eyes on intervention. We're also seeing a new cycle low in AUD/USD, which is down 87 pips to 0.6188.