- Prelim was 53.3

- Prior was 50.1

- Services 52.6 vs 53.8 prelim

- Prior services 50.6

- Services prices index declined

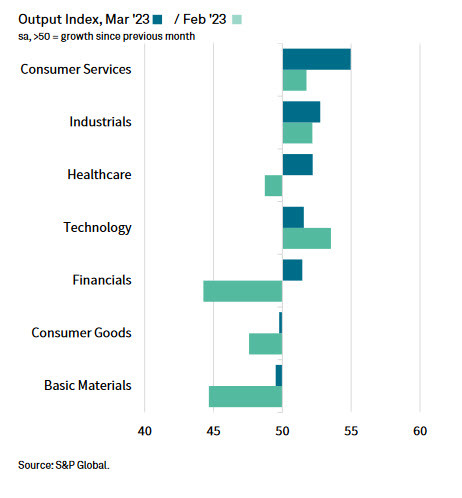

The ISM services number is out at the top of the hour and the consensus is a dip to 54.5 from 55.1. This number from S&P Global indicates some late-month downward pressure, undoubtedly due to the bank rout.

Siân Jones, Senior Economist at S&P Global Market Intelligence, said:

"Business activity across the service sector expanded at a faster pace in March, as a return to new order growth offered a tonic to the US economy, which saw the fastest rise in private sector output since last June. Improvements in customer spending across the service economy counteracted another fall in manufacturing sales.

"Greater service sector demand and increased pressure on capacity spurred another round of job creation, with the rate of employment growth quickening slightly to a six-month high.

"Concerns regarding the impact of inflation and higher interest rates on customer spending remained apparent, however. Optimism at goods producers and service providers dipped since February amid elevated cost pressures.Nonetheless,selling price inflation accelerated again due to more accommodative demand conditions. A sharper rise in charges contrasted with the trend for input prices, which increased at the second-slowest pace since October 2020."