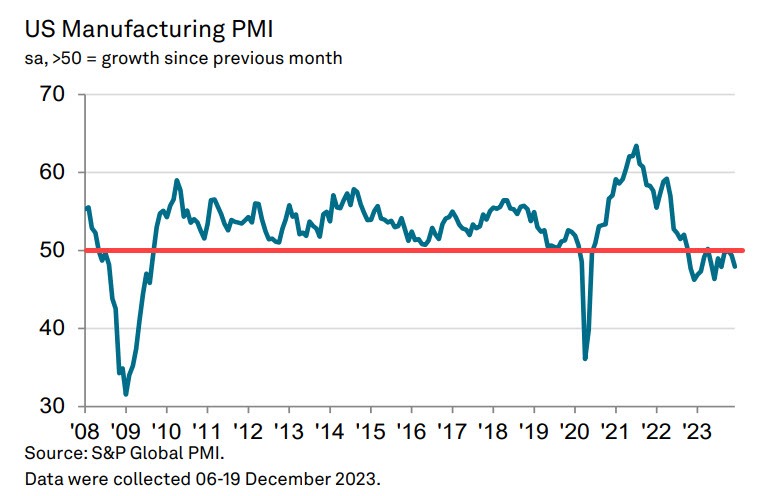

- Prior 48.2 preliminary. Prior month was 40.4

- S&P global manufacturing index for December 47.9 versus 48.4 estimate

- Only two months in 2023 were above the 50.0 level

Highlights from the S&P global:

- US Manufacturing Sector Decline: The sector experienced a contraction in December, marked by a decrease in output and a faster downturn in new orders.

- Weak Demand: Lower new sales were due to weak domestic and international demand, leading firms to reduce input buying and hiring.

- Greater Spare Capacity Indicators: Faster fall in backlogs and destocking, along with efforts to manage cashflow, indicated more spare capacity.

- Inflationary Pressures: Costs rose sharply, and selling prices increased at the fastest rate since April.

- PMI Decline: The S&P Global US Manufacturing PMI dropped to 47.9 in December, indicating a modest but accelerated decline in the sector's health.

- Sharp Fall in New Orders: There was a notable decrease in sales, the fastest since August, mainly due to lower purchasing power among customers and global economic uncertainty.

- Export Orders in Contraction: New export orders declined marginally.

- Production Decrease: For the first time in four months, production levels dropped, influenced by higher input prices and slower production processes.

- Employment Reduction: Companies reduced employment at a rate comparable to early pandemic levels due to concerns about excess operating capacity.

- Cost Increases Amid Sluggish Sales: Despite slow sales, firms raised selling prices, while employment continued to drop.

- Backlogs and Inventories: There was a steeper contraction in backlogs and a decline in both pre- and post-production inventories.

- Business Optimism: Despite challenges, business confidence in the manufacturing sector reached a three-month high in December.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

US manufacturers ended the year on a sour note, according to S&P Global's PMI survey. Output fell at the fastest rate for six months as the recent order book decline intensified. Manufacturing will therefore likely have acted as a drag on the economy in the fourth quarter.

The slowdown is spreading to the labor market. Payrolls were cut for a third month running as increasing numbers of firms grew concerned about the development of excess operating capacity. The fourth quarter has consequently seen factories reduce employment at a pace not seen since 2009 barring only the early pandemic lockdown months.

With factories also cutting back sharply on their purchases of inputs in December, suppliers were also less busy on average, again hinting at the development of spare capacity. “While there was some uplift in the rate of both raw material and factory gate selling price inflation, firms' costs notably continued to rise at a pace below the survey’s long-run average to hint at historically subdued industrial price pressures. “

Given current order book trends, the overall picture from

the survey is one of supply exceeding demand for many

goods, which points to downside risks to production,

employment and prices as we head into 2024. Potential

supply chain disruptions need to be monitored, however,

notably in terms of shipping, as the survey has clearly

demonstrated in the past how supply chain tensions quickly

feed through to higher prices.

The US 2-year yield is trading up 7.0 basis points at 4.320%. The 10-year yield is trading up 6.6 basis points to 3.925%. For the 10-year yield it is trading near its low yield for the day.

The US dollar is still near its highs but off its highest levels. The USDCAD, however, continues its run to the upside. It's S&P global index came at the lowest level since 2020.