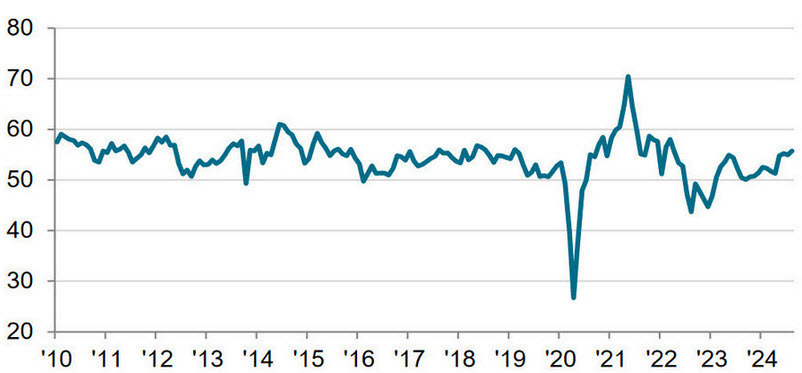

- Prelim was 54.3

- Prior was 55.2

- Composite index 54.1 vs 54.3 prelim (54.0 prior)

- Employment falls for third straight month but only marginally

- Output price inflation cools to joint-lowest in 4.5 years

- New export orders growth slows to 4-month low

- Business confidence rebounds to highest since June

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence :

“The US service sector notched up another strong performance in October, helping offset the current weakness of the manufacturing sector to drive a solid pace of overall economic growth again at the start of the fourth quarter.

"The services economy's consistently impressive growth in recent months has helped the US outperform all other major developed economies. October's strong performance is consistent with GDP continuing to rise at an annualized rate in excess of 2%.

"Particularly welcome news comes from the cooling inflation picture. Average prices charged for services rose at a sharply reduced rate in October, showing one of the smallest increases seen for over four years, as competition intensified in the services economy.

"Firms' expectations for the coming year have meanwhile perked up from a slump in September, though much uncertainty persists in relation to the business climate after the election, causing many firms to pause hiring until the political landscape becomes more settled."

The ISM services index is due at the top of the hour, this report add some slight downside risk but the drop in prices is a good sign.