UPCOMING EVENTS:

- Monday: China Caixin Manufacturing PMI, US ISM Manufacturing PMI, BoC Business Outlook Survey.

- Tuesday: RBA Minutes, Switzerland Retail Sales, Switzerland Manufacturing PMI, German Inflation data, US Job Openings.

- Wednesday: China Caixin Services PMI, Eurozone CPI and Unemployment Rate, US ADP, Canada Services PMI, US ISM Services PMI.

- Thursday: Switzerland CPI, Eurozone PPI, US Challenger Job Cuts, US Jobless Claims.

- Friday: Eurozone Retail Sales, Canada Jobs data, US NFP.

Monday

The US ISM Manufacturing PMI is expected at 48.4 vs. 47.8 prior. The recent S&P Global US Manufacturing PMI beat expectations rising for the third consecutive month highlighting a pickup in activity in the Manufacturing sector in Q1 2024. The commentary in the report was generally upbeat, but there were also some worrying signals on the inflation part saying that “A steepening rise in costs, combined with strengthened pricing power amid the recent upturn in demand, meant inflationary pressures gathered pace again in March. Costs have increased on the back of further wage growth and rising fuel prices, pushing overall selling price inflation for goods and services up to its highest for nearly a year.

Tuesday

The US Job Openings are expected at 8.790M vs. 8.863M prior. This will be the first major US labour market report of the week and, although it’s old (February data), it’s generally a market moving release. The last report we got a miss with negative revisions to the prior readings highlighting a resilient although weakening labour market. The market will also focus on the hiring and quit rates as they both fell below the pre-pandemic trend.

Wednesday

The Eurozone CPI Y/Y is expected at 2.6% vs. 2.6% prior, while the Core Y/Y measure is seen at 3.0% vs. 3.1% prior. The market is fully pricing the first rate cut in June and given the consensus within the ECB itself, we will likely need a huge miss in the data to see the market pricing in an April move. We got a miss in the French CPI readings last Friday and we will get the German figures the day before, which should guide the expectations for the Eurozone CPI. We will also see the latest Unemployment Rate which is expected to remain unchanged at the record low of 6.4%.

The US ISM Services PMI is expected at 52.6 vs. 52.6 prior. The recent S&P Global US Services PMI missed expectations slightly falling to a three-month low although the commentary in the report was generally good saying that “Service providers reported a slower pace of expansion linked in part to ongoing cost of living pressures. However, service providers have also become increasingly optimistic about the outlook, with confidence striking a 22-month high in March.” The most important data to watch will be the price and employment sub-indexes.

Thursday

The Switzerland CPI Y/Y is expected at 1.4% vs. 1.2% prior, while the M/M measure is seen at 0.3% vs. 0.6% prior. As a reminder, the SNB decided to cut rates by 25 bps at the March meeting given the steady easing in inflation and the rate being well within the 0-2% target since last summer. Further easing in the data should see the market fully pricing in another rate cut in June from the current 60% probability.

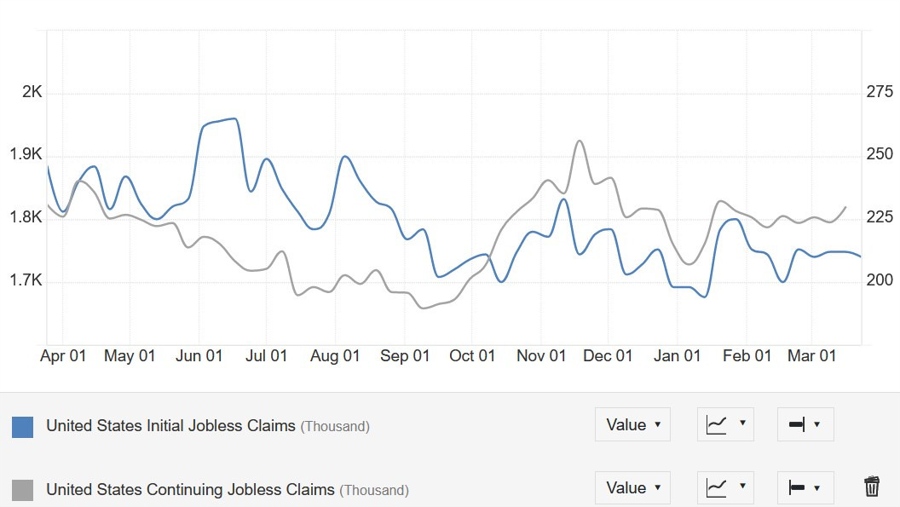

The US Jobless Claims continue to be one of the most important releases every week as it’s a timelier indicator on the state of the labour market. This is because disinflation to the Fed's target is more likely with a weakening labour market. A resilient labour market though will make the achievement of the target much more difficult. Initial Claims keep on hovering around cycle lows, while Continuing Claims remain firm around the 1800K level. There’s no consensus at the time of writing although the last week we saw Initial Claims beating expectations at 210K vs. 212K expected and Continuing Claims rising slightly to 1820K from the prior positively revised 1790K figure.

Friday

The US NFP report is expected to show 200K jobs added in March vs. 275K in February with the Unemployment Rate seen unchanged at 3.9%. The Average Hourly Earnings Y/Y is expected at 4.1% vs. 4.3% prior, while the M/M measure is seen at 0.3% vs. 0.1% prior. The general expectation into the report is positive given the strong Jobless Claims and the Present Situation Index, which might further be consolidated by the employment components in the ISM PMIs. Fed Chair Powell said that an “unexpected” weakening in the labour market could warrant a policy response but that will likely require the Sahm Rule to be triggered, which would need the Unemployment Rate to jump to 4.4%.

The Canadian Labour Market report is expected to show 25K jobs added in March vs. 40.7K in February with the Unemployment Rate ticking higher to 5.9% vs. 5.8% prior. The market will be particularly focused on the wage growth data as that’s what the BoC is most concerned with.