UPCOMING EVENTS:

- Monday: Japan Industrial Production and Retail Sales, Chinese PMIs, German CPI, Fed Chair Powell. (Canada on Holiday)

- Tuesday: Japan Unemployment Rate, BoJ Summary of Opinions, Australia Retail Sales, Swiss Retail Sales, Swiss Manufacturing PMI, Eurozone Flash CPI, Canada Manufacturing PMI, US ISM Manufacturing PMI, US Job Openings. (China on Holiday)

- Wednesday: Japan Tankan Index, Eurozone Unemployment Rate, US ADP. (China on Holiday)

- Thursday: Swiss CPI, Eurozone PPI, US Jobless Claims, Canada Services PMI, US ISM Services PMI. (China on Holiday)

- Friday: Swiss Unemployment Rate, US NFP. (China on Holiday)

Tuesday

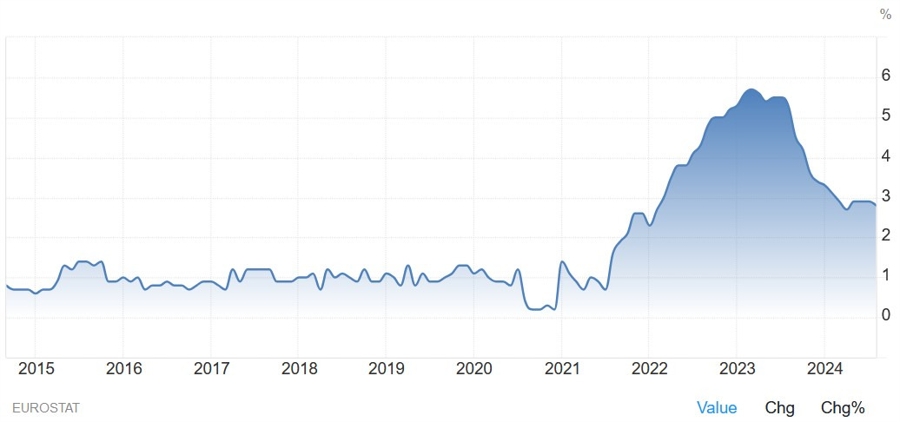

The Eurozone CPI Y/Y is expected at 1.9% vs. 2.2% prior, while the Core CPI Y/Y is seen at 2.8% vs. 2.8% prior. The market has already priced in a back-to-back 25 bps cut in October following the weak PMIs, and the soft French and Spain CPI numbers last week. The expectations are for the ECB to cut by 25 bps at each meeting until June 2025.

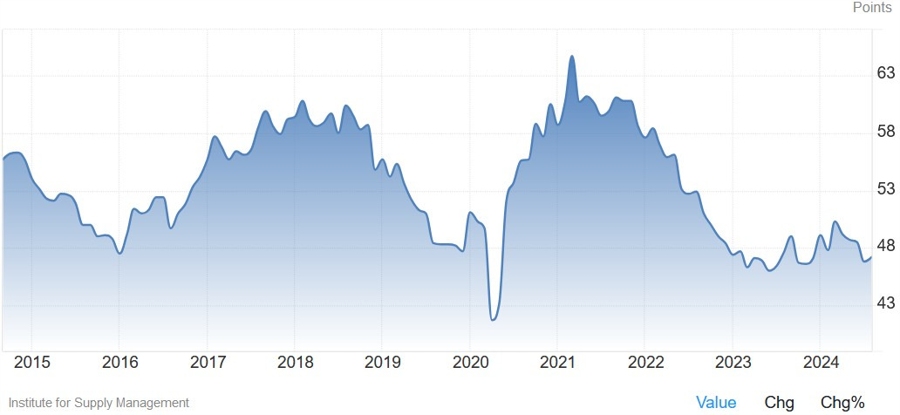

The US ISM Manufacturing PMI is expected at 47.5 vs. 47.2 prior. This and the NFP report are going to be the most important economic releases this week. The S&P Global PMIs last week showed the Manufacturing index falling further into contraction.

It’s unlikely that those PMIs and maybe even the ISM PMIs incorporated the latest Fed’s decision. The ISM data though is collected the last week of the month, so there might be some improvement compared to the S&P Global report.

Given the focus on global growth following the Fed and especially the PBoC decisions, the market might be ok with a benign figure and cheer a strong rebound.

The New Orders index should be the one to watch as it should be the first to respond to the recent developments. The focus will also be on the Employment index ahead of the NFP report on Friday.

The US Job Openings is expected at 7.670M vs. 7.673M prior. The last report surprised to the downside with a big drop. Despite that, the hiring rate improved slightly while the layoffs rate remained low. It’s a labour market where at the moment it’s hard to find a job but also low risk of losing one. We will see in the next months how it evolves following the recent developments.

Thursday

The Switzerland CPI Y/Y is expected at 1.1% vs. 1.1% prior, while the M/M figure is seen at -0.1% vs. 0.0% prior. As a reminder, the SNB last week cut rates by just 25 bps bringing the policy rate to 1.00% and said that it’s prepared to intervene in the FX market as necessary.

The central bank also revised its inflation forecasts significantly lower leading the market to price in more rate cuts beyond December 2024. Despite this, the Swiss Franc strengthened as the market probably saw it as a weak move.

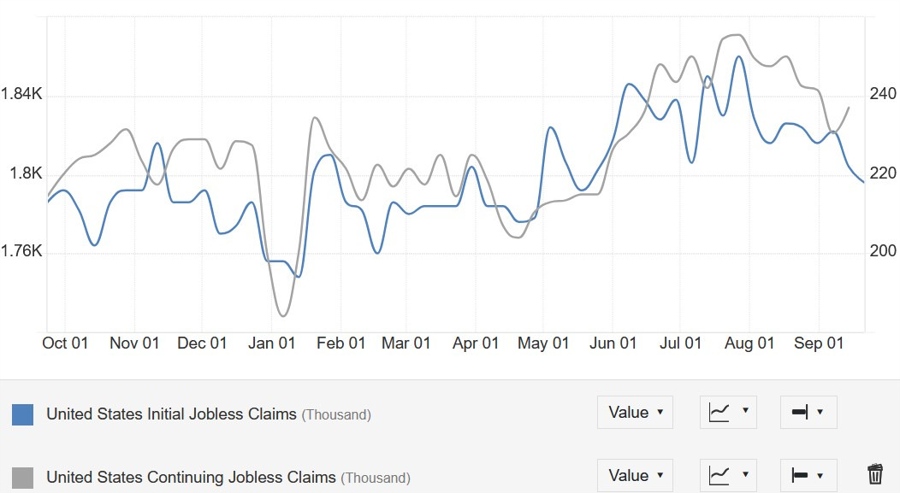

The US Jobless Claims continues to be one of the most important releases to follow every week as it’s a timelier indicator on the state of the labour market.

Initial Claims remain inside the 200K-260K range created since 2022, while Continuing Claims after rising sustainably during the summer improved considerably in the last weeks.

This week Initial Claims are expected at 220K vs. 218K prior, while there’s no consensus for Continuing Claims at the time of writing although the prior release showed an increase to 1834K.

The US ISM Services PMI is expected at 51.6 vs. 51.5 prior. This survey hasn't been giving any clear signal lately as it’s just been ranging since 2022, and it’s been pretty unreliable. The market might focus just on the employment index ahead of the NFP report the next day.

The recent S&P Global Services PMI noted that “the early survey indicators for September point to an economy that continues to grow at a solid pace, albeit with a weakened manufacturing sector and intensifying political uncertainty acting as substantial headwinds”.

“The sustained robust expansion of output signalled by the PMI in September is consistent with a healthy annualized rate of GDP growth of 2.2% in the third quarter. But there are some warning lights flashing, notably in terms of the dependence on the service sector for growth, as manufacturing remained in decline, and the worrying drop in business confidence”.

“A reacceleration of inflation is meanwhile also signalled, suggesting the Fed cannot totally shift its focus away from its inflation target as it seeks to sustain the economic upturn.”

Friday

The US NFP report is expected to show 140K jobs added in September vs. 142K in August and the Unemployment Rate to remain unchanged at 4.2%. The Average Hourly Earnings Y/Y are seen at 3.8% vs. 3.8% prior, while the M/M figure at 0.3% vs. 0.4% prior.

The Fed projected a 4.4% unemployment rate by the end of the year with 50 bps of easing. The unemployment rate in 2024 has been rising due to increased labour supply rather than more layoffs, which is something that jobless claims have been capturing well.

The market is pricing a 53% probability of another 50 bps cut in November and that could very well increase if the NFP report were to be weak. Of course, the opposite is true if the labour market report were to come in better than expected with a 25 bps cut becoming the most likely move.