CFTC Commitments of Traders highlights for the week ending Oct 31, 2017:

- EUR long 72K vs 84K long last week. Longs trimmed by 12K.

- GBP long 1K vs 1K short last week. Position shifts to small long from small short last week.

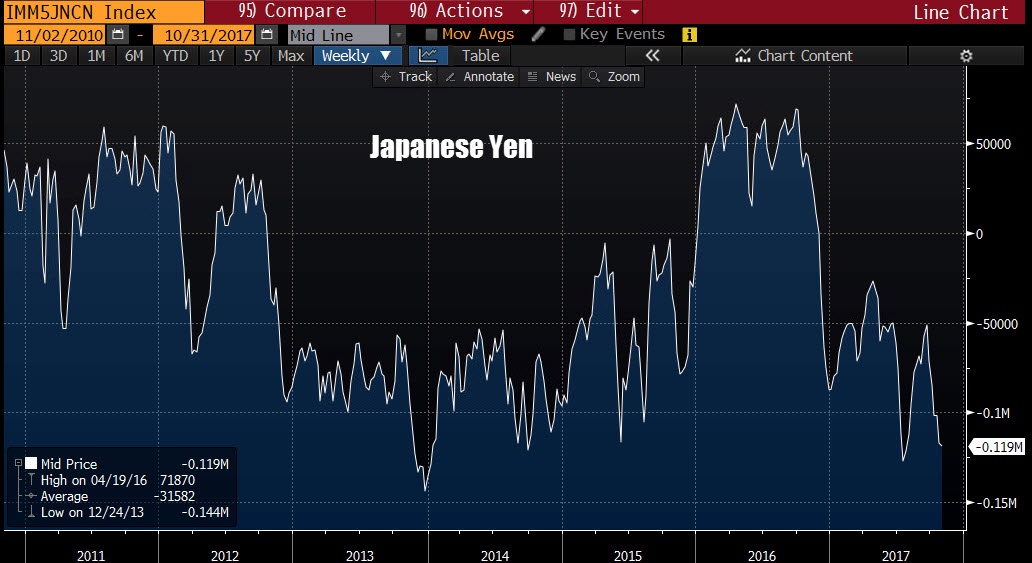

- JPY short 119K vs 116K short last week. Shorts increased by 3K

- CHF short 21K vs 12K short last week. Shorts increased by 9K

- CAD long 58K vs 72K long last week. Longs trimmed by 14K.

- AUD long 52k vs 57K long last week. Longs trimmed by 5K

- NZD short 6K vs 1K long last week. Position shifted to short.

- Last week's data

Highlights:

- Some of the CAD longs were squeezed out as the CAD weakened into Tuesday. The CAD has strengthened a bit since that low.

- The JPY shorts remain near record levels going back to 2011 (at least - see chart below). The USDJPY tested the highest level going back to May this week. Shorts in the JPY are benefiting from that move.

- EUR longs were trimmed in the current week but a core long position remains. The price of the EURUSD fell sharply on Friday last week - breaking below the 100 day MA and the 200 week MAs. This week the price traded up and down and is a little higher from Friday's closing levels last week.