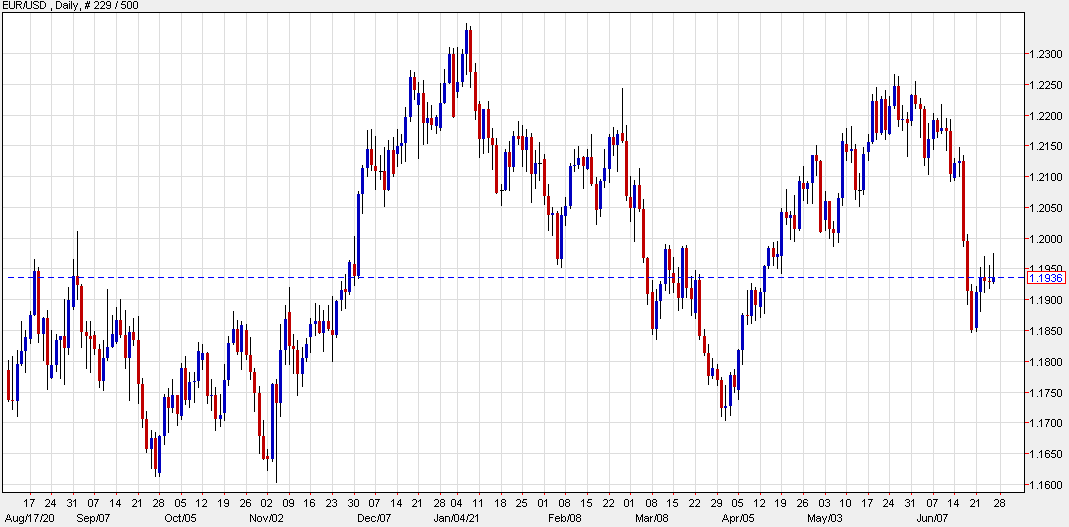

Weekly forex futures positioning data for the week ending June 22, 2021:

- EUR long 89K vs 118K long last week. Longs trimmed by 29K

- GBP long 18K vs 32K long last week. Longs cut by 18K

- JPY short 53K vs 47K short last week. Shorts increased by 7K

- CHF long 14K vs 9K long last week. Longs increased by 4K

- AUD short 17K vs 18K short last week. Shorts trimmed by 1K

- NZD long 3K vs 3K long last week. No change

- CAD long 43K vs 44K long last week. Longs trimmed by 1K

There were substantial shifts into euro and GBP longs in the lead up to the FOMC decision. That left a big chunk of the market vulnerable to the Fed surprise. Afterwards, there was a bit of rush to the exits and that likely exaggerated last week's rally in the dollar. I'm surprised we didn't see that in CAD as well but those proved to be stronger hands.