AUDUSD higher on the day but between levels

Twenty four hours ago, the AUDUSD was sitting around the 100 day MA as retail sales, current account data, and the RBA decision was ahead in the new day. The retail sales were worse than expected. The current account showed a greater than expected deficit. Later the RBA came in as expected.

The price action today saw the AUDUSD move higher helped by overtures of denuclearization from North Korea, and some easing of tariff fear (although both are really not guaranteed).

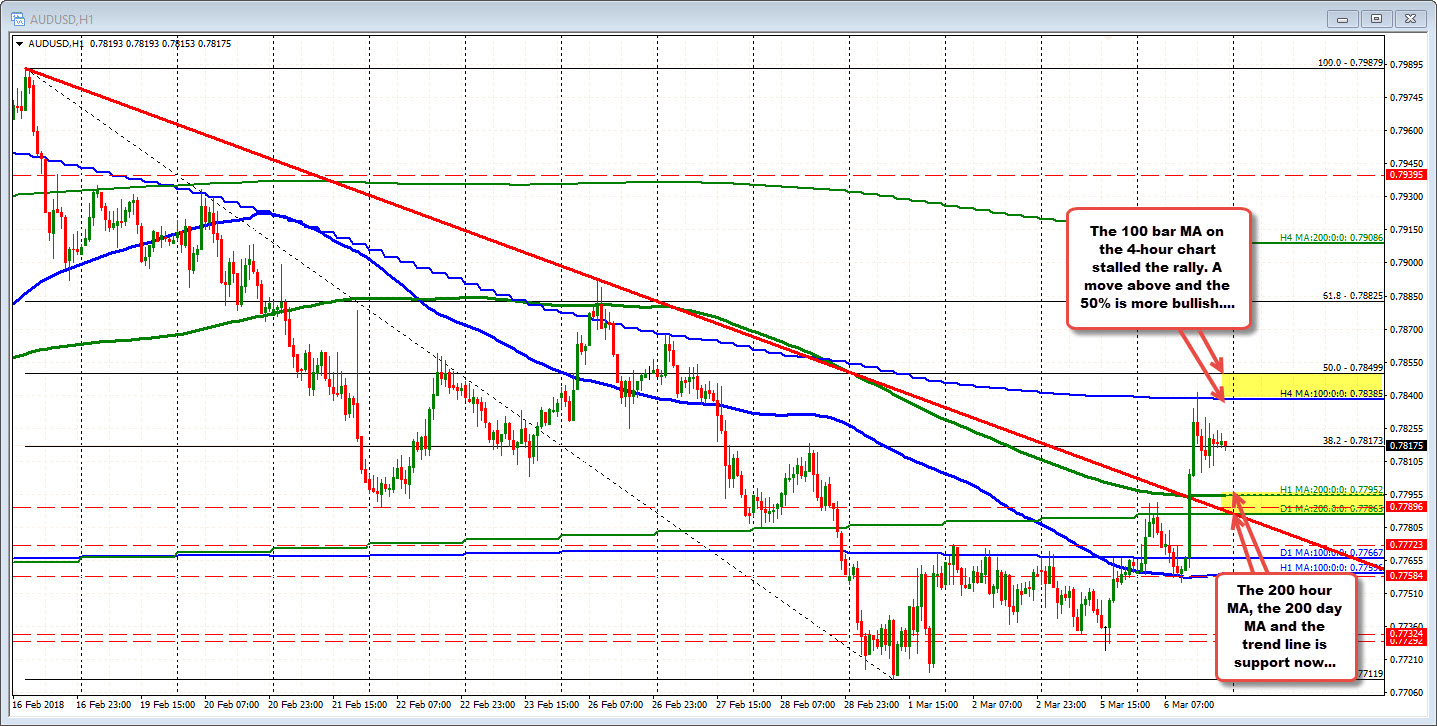

Technically, the price moved above the:

- 200 day MA at 0.7786

- 200 hour MA at 0.7795 and

- A trend line connecting highs from Feb 16 and Feb 26th on the hourly chart (see chart above). That trend line comes in at 0.7787.

All those breaks, helped to turn the bias more bullish and will remain a key area through the GDP report in the new trading day. Stay above 0.7786-95 and the buyers remain in control. Move below, and the sellers will have more confidence once again.

On the upside, the 100 bar MA on the 4-hour chart did a good job of stalling the run up today That MA comes in at 0.78385. The 50% retracement of the move down from the February 16th high cuts across at 0.78499 (call it 0.7850). Moves above those levels will be more bullish.

The GDP will be released at 7:30 PM ET/0030 GMT, with the expectation of 0.5% QoQ and the YoY at 2.5%. That compares to 0.6% and 2.8% in the 3Q.