No set timing for balance sheet trimming

The FOMC minutes showed no clear balance sheeting timing but the dip in the dollar has seen a bounce back.

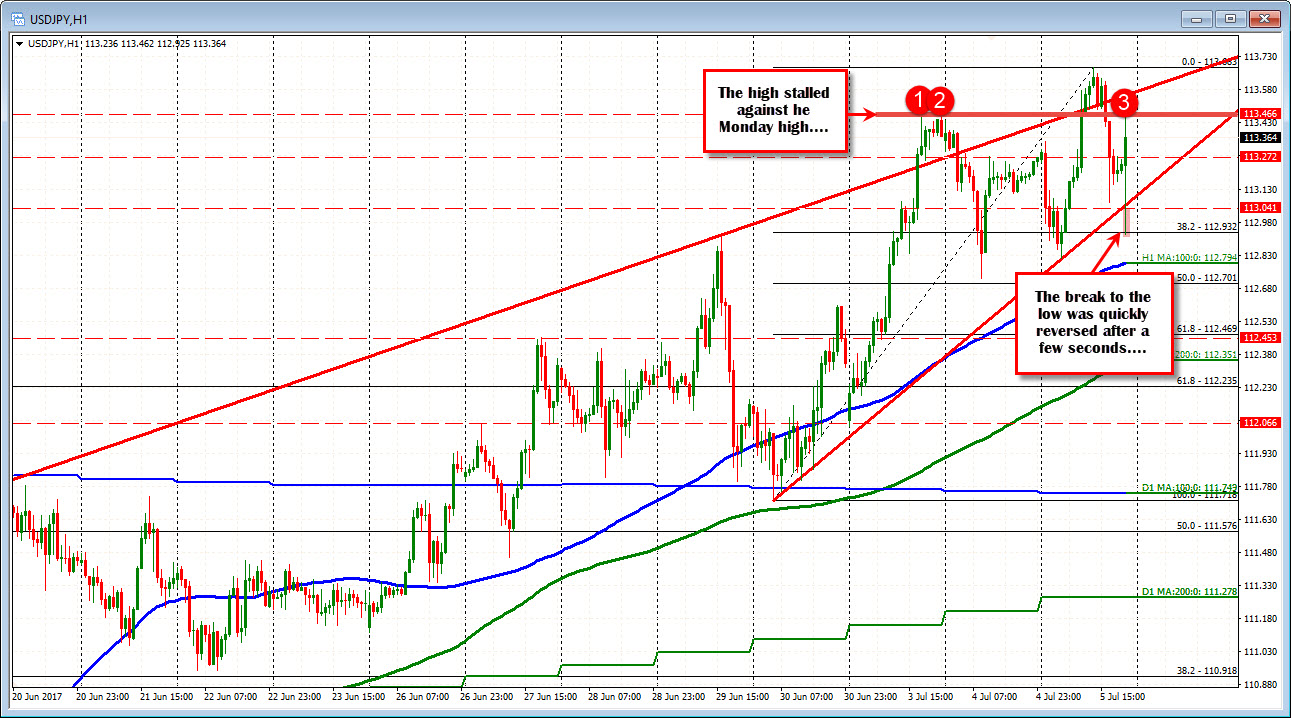

The USDJPY quickly dipped below 113.00 to 112.93 but moved back almost instantly back higher and trades at 113.33 now.

The EURUSD moved up to 1.1353 but is back down testing the 200 hour MA at 1.1332 level.

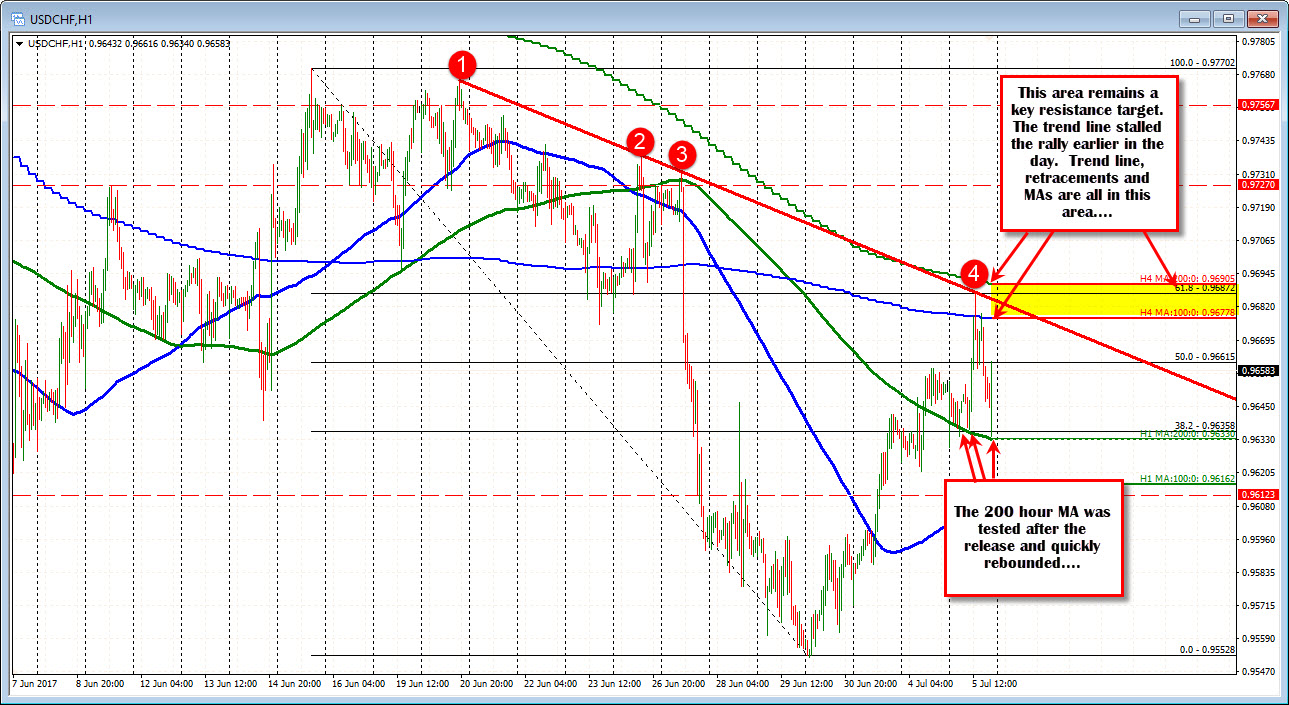

The USDCHF tested its 200 hour MA at 0.9633, and it bounced higher to 0.9661 currently. The low went to 0.9634. ON the topside, the 0.9677-905 has lots of overhead resistance.

The 2 year yield is little changed at 1.414% vs 1.406% prior to the release. The 10 year is at 2.342% vs 2.33%.

The S&P is up 1.77 points vs 2.61 points before the report. The Nasdaq is up 36.44 points vs up 38 points before the report.

Overall, the reaction supports a higher dollar, but the highs for the day (in the USD) remain.

Stocks and bonds are little changed as well.