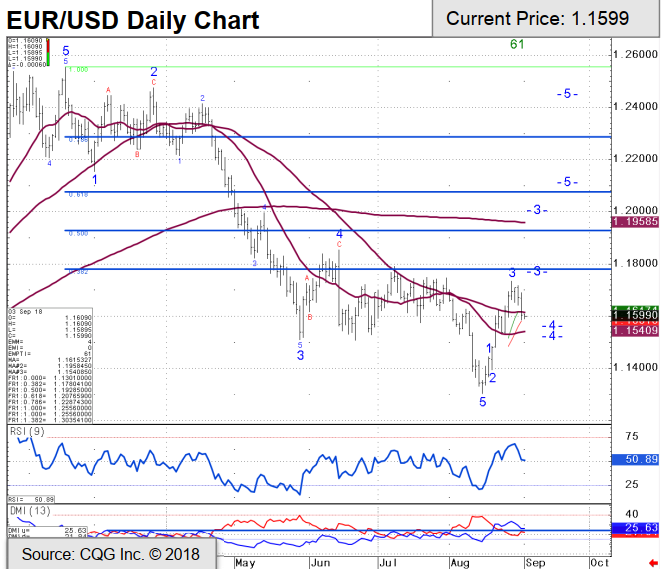

Commerzbank chart of the euro against the US dollar, an a long EUR/USD position

The bank has a current position 'holding tiny longs 1.1625', their recommended trade:

- Add 1.1560, stop 1.1505. Exit 1.1900

- On Friday EUR/USD continued to back away from resistance offered by the 1.1745/50 area and the 1.1790 recent high. These should continue to act as a tough near term barrier. A recovery above here will trigger a move to the 1.1853 mid-June high and the 1.1917 55 week ma. We suspect that the recent low at 1.1301 was a significant turn for the market.

- Initial support lies at 1.1541 20 day ma. The cross will need to drop sub 1.1508 to alleviate immediate upside pressure. Currently near term dips lower are indicated to hold around 1.1560/20.

- Where are we wrong? A drop below the 1.1508 June low would retarget the current August low at 1.1301.

- Short term trend (1-3 weeks): Stabilized in the 1.1300 region and is heading back up towards the 1.1750/90 zone.

- Long term trend (1-3 months): Recent low at 1.1301 viewed as an interim low