ArticleBody

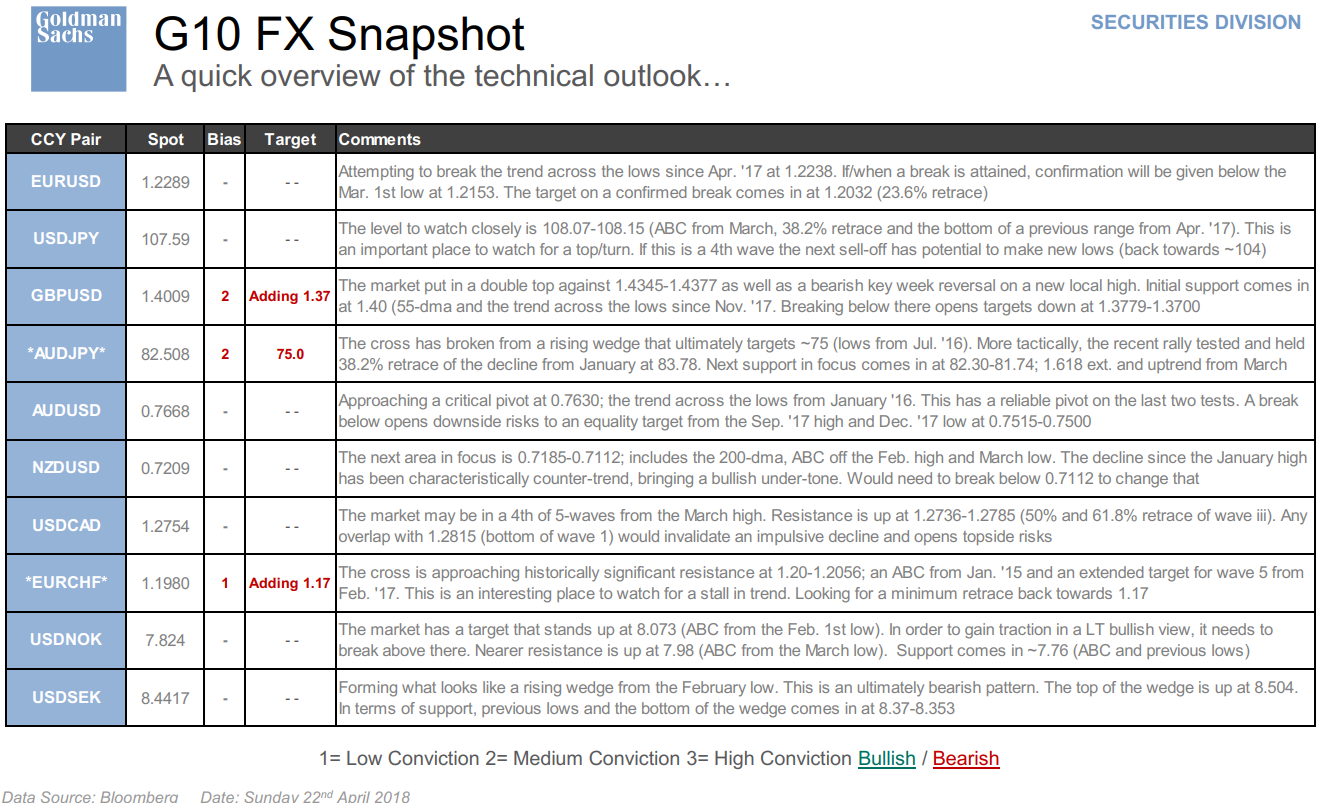

From Goldman Sachs' weekly technical analysis note The Charts That Matter Next Week

Although I picked out the AUD in the headline above, there is plenty more.

The bank also suggest that GBP/USD is only at the beginning of a corrective pull back and has further to fall:

It's currently testing initial support at 1.40

- the area includes the 55-dma as well as the trend across the lows since Nov. '17. Breaking below there will further confirm the double formation at 1.4345-1.4377. The pattern has a neckline that stands down at 1.3712 (Feb. 27th low)

There are around four separate levels that converge down at 1.3779-1.37; one of which is the primary uptrend from Mar. '17 lows

The run up to Monday's peak can be interpreted as a complete 5-wave sequence from the low in Oct. '16.

- The fact that it posted a bearish key week reversal and a double top increases the likelihood that a high is now in place. Bottom line, expecting a period of counter-trend price action, to retrace at least 23.6% of the entire advance back to 1.3779. Will need an ABC correction before getting comfortable with resuming the underlying uptrend.