Crude sizzles higher

So much for the mini-correction in oil.

WTI crude oil is now up $1.08 on the day to $59.34. It traded as low as $57.41 earlier.

Brent sailed through $60 this month and is now testing $62. Will WTI be the next? If today's candle holds that bodes well on the technical side.

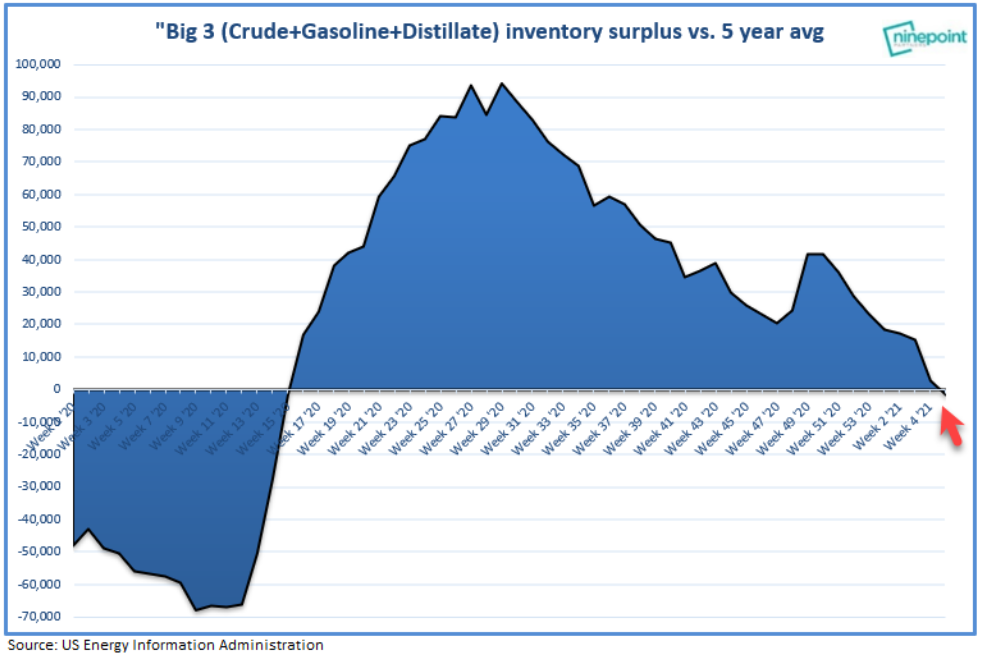

The fundamental side is also improving much more quickly than anticipated, despite lockdowns. Here's a chart from Ninepoint showing combined crude, gasoline and distillate inventories falling below the 5-year average.

I've been writing about the lack of investment in oil for months but the gains are unfolding much more quickly than I anticipated. The problem is that oil companies simply aren't investing in replacing production that's running off. At best they're holding production flat and directing cash towards paying down debt as banks and Wall Street starve them of capital.

Even Goldman Sachs is talking about an oil supercycle now.

"I want to be long oil and hang on for the ride," Goldman's Jeff Currie said in an interview with S&P Global Platts on Feb. 5, warning "there is a lot of upside here."

"Is it back to $150/b? I don't know... as it is a macro repricing we are talking about and everything needs to reprice."

How does that sound? While oil itself and CAD, RUB or NOK would be good bets on crude, oil company shares remain extremely depressed.