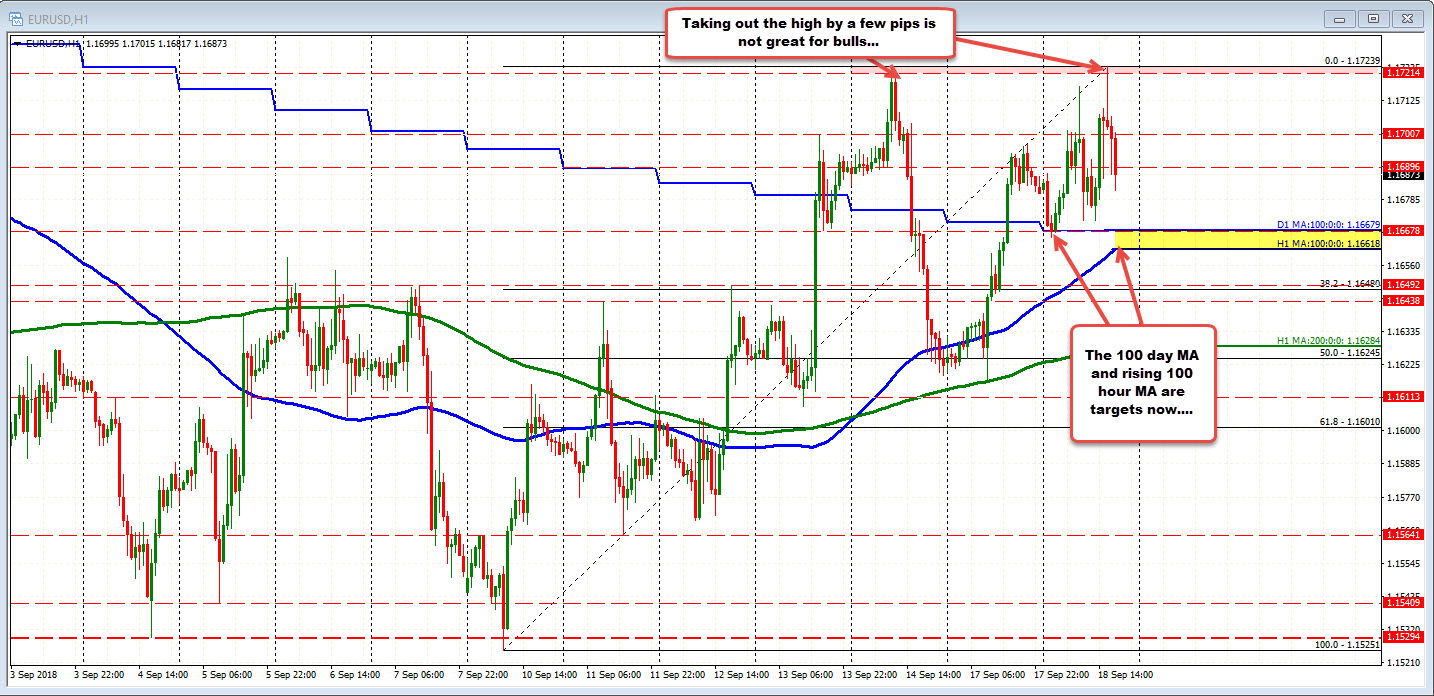

Moved away from the 100 day MA but made new month high by a few pips and failed.

There is good and bad in the price action in the EURUSD today. The last action was bearish.

Looking at the hourly chart above. The good/bulllish for the price action today is that the price (apart from an early Asian sell off), stayed above the 100 day MA at 1.16679. That is bullish.

The not so good (or bearish) is that the pair took out the high from Friday (the high for the month of September) at 1.17214 only to get to 1.17239 and reverse back lower (only 2-3 pips higher). Making a new high by 2 -3 pips and reversing back lower is not what you want to see if bullish.

So the sellers are making a play.

What will make the picture more bearish is a break below the 100 day MA at 1.16679 and the rising 100 hour MA at 1.16618. Those are the targets now on more selling. I don't think that break will be easy, but it seems the dollar selling momentum has eased and if the rally has run it's course for now, a break below that MA would spoil the mood for the bulls.