Key level for both NAFTA currency pairs

While the NAFTA discussions continue between US and Mexico (and Canada cheers on from the sidelines), the CAD and the MXN are not doing all that well. It is thought that if there is an agreement, that would be good for those currencies but the devil is in the details of course. What it would do is reverse the tariffs which are a drain on all economies.

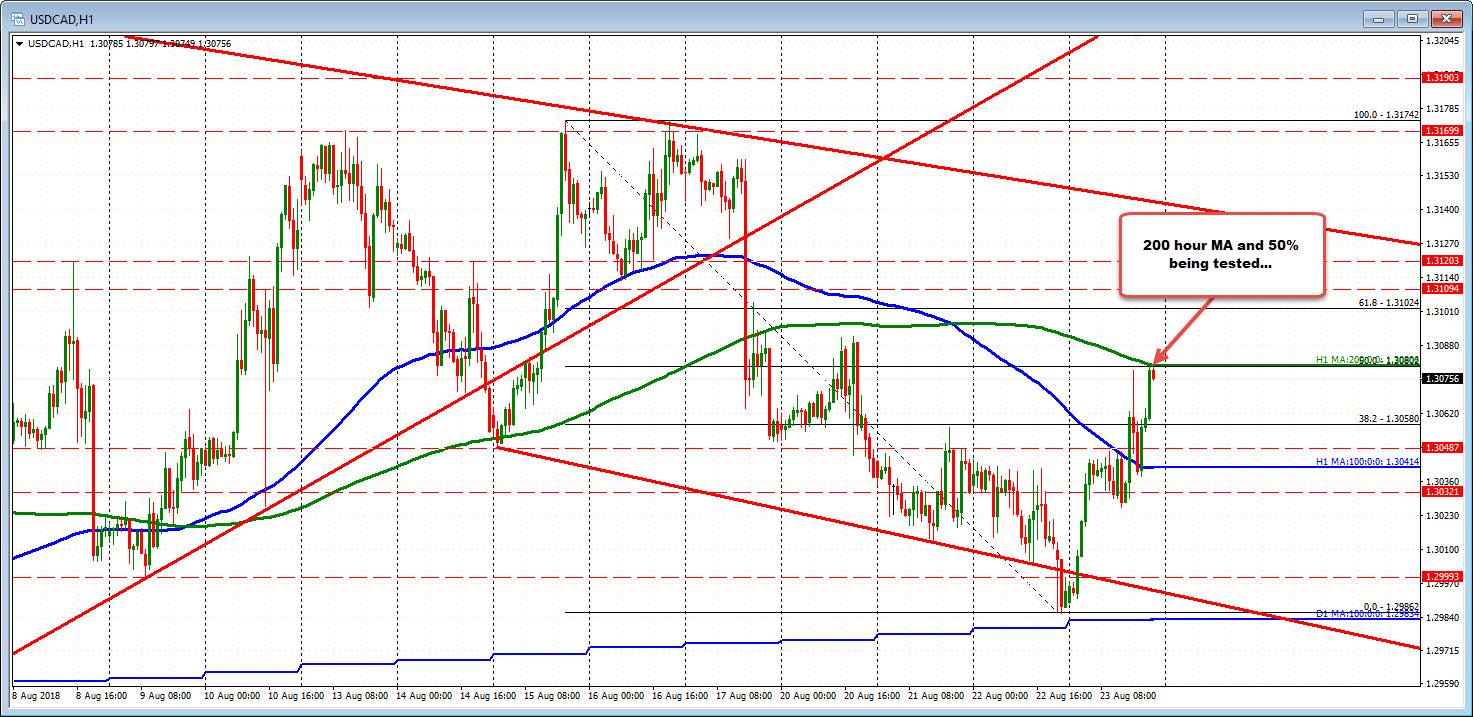

Technically, the USDCAD is up testing a key target at the 200 hour MA and 50% retracement at 1.3080 area. The combination should attract sellers against the level.

For the USDMXN, the pair took a peek above the 100 hour MA and trend line, but is trading back below each (see chart below).

Are sellers leaning? With uncertainty from the talks it make sense but expect that if the levels are broken, that the shorts would not wait too long to cover.