The dollar is making a run to the upside. There are new highs for the day versus the JPY, CHF, CAD, AUD and NZD. The GBPUSD is testing its earlier lows.

- USDJPY: The USDJPY is trading to a new session high extending above the high from yesterday at 138.904 by a few pips so far. The 100 hour moving average at 138.363 currently held support earlier in the day on 2 separate tests. It would take a move below that level to increase the bearish bias in the short term. Closer support now will be allied against last week's high at 138.73.

- USDCHF: The USDCHF has moved above a swing area between 0.9027 and 0.90358. The current price trades at 0.90495. Stay above 0.90274 keeps the buyers in firm control. The high from last week at 0.90621 is the next target followed by a swing area between 0.9070 and 0.9080.

- USDCAD: The USDCAD is trading at the highest level since May 4 and looks toward the 1.36000 level. The current price is trading at 1.3592. The move to the upside today extended above a swing area between 1.3553 and 1.3566, and a swing level at 1.35825 (see chart below).

USDCAD breaks higher

- AUDUSD: The AUDUSD is falling below a key swing area low at 0.65448 (see red numbered circles on the chart below). The price is also falling below the March low at 0.65639 (low for the year). The old low is now a close risk level for the pair in the short-term. More conservative risk comes in at 0.65847. Traders would want to see the price remain below those levels to keep the sellers firmly in control with the door open for more downside momentum the reward.

AUDUSD trades to new 2023 lows

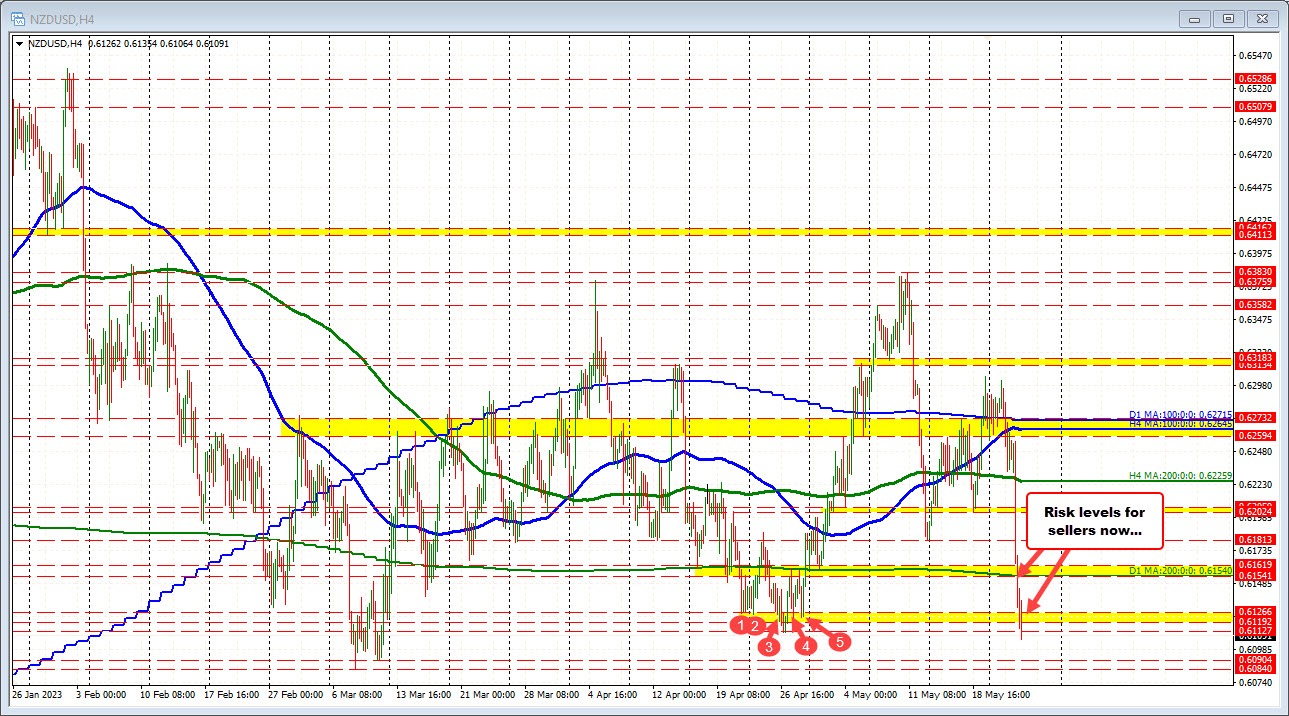

- NZDUSD: The NZDUSD is trading to a new low going back to March 10, 2023. The low for the year was also reached in March down to 0.6084. The current price trades at 0.6110 (26 pips to new year lows). The move lower today has taken the price back below a swing area between 0.6119 at 0.61286. That is a close risk for sellers now. A more conservative risk would be the 200-day moving average at 0.6154. The price moved below that moving average level today for the 1st time since April 28. The RBNZ raise rates by 25 basis points today. There was pre-meeting talk of a possible 50 basis point hike. Instead, the debate was between 0 bps and 25 bps. The RBNZ did take a vote of 5-2 in favor of the hike.

NZDUSD falls to lowest level since March 2023