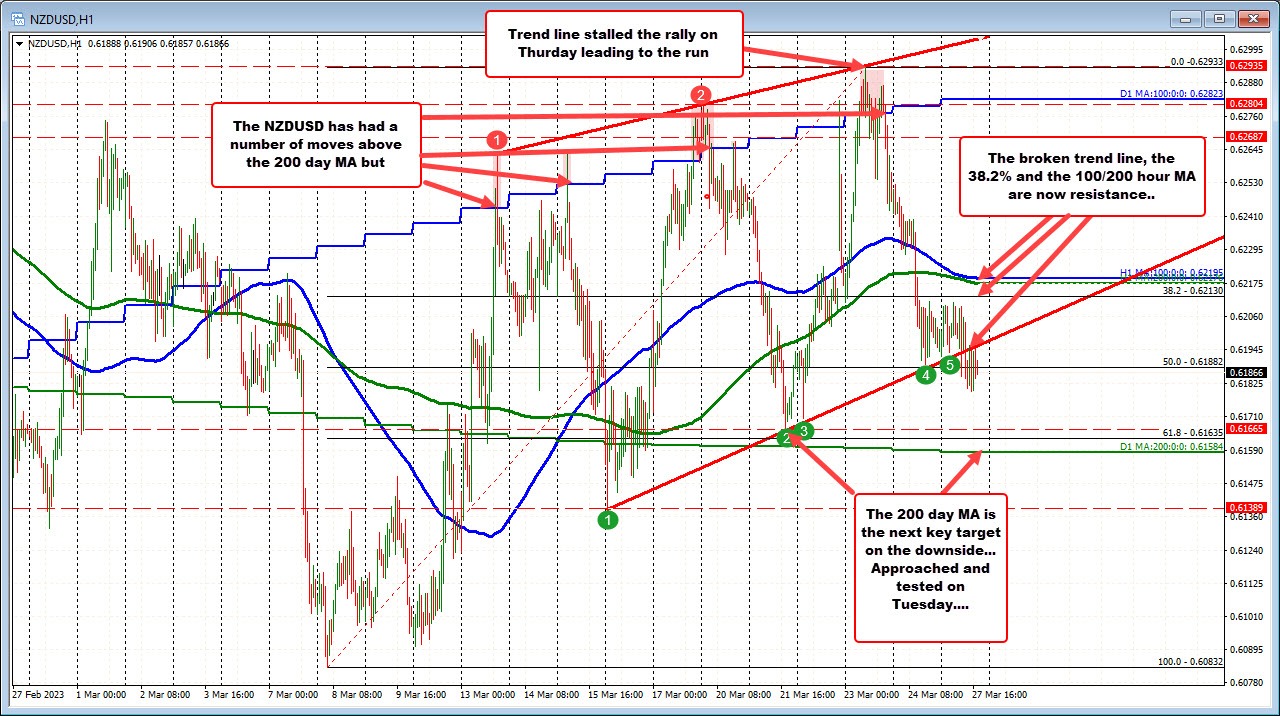

The NZDUSD has experienced several short-lived up and down moves over the past few weeks. On the upside, the price has occasionally surpassed the rising 100-day moving average (see higher blue step line and red shaded areas) but ultimately lost momentum and sharply reversed. The most recent break higher occurred on Thursday, with the high price stalling against a topside trendline, prompting sellers to lean in.

On the downside, recent lows have found support at progressively higher levels (see green numbered circles). Friday's decline and today's Asian session low both stalled against that upward-sloping trendline. However, during the London morning session today, the price broke below this trendline, shifting the technical bias further in favor of sellers. The underside of the broken trendline is currently around 0.6197 (approximately 0.6200), and staying below this level in the short term keeps sellers firmly in control. A move above this level could trigger corrective upside probing on the failed break (close risk for sellers now).

The short-term bearish bias is reinforced by the price falling back below the converging 100 and 200-hour moving averages near 0.6218. Although the price has fluctuated around these moving averages since March 15, with the price now below both the moving averages and the upward-sloping trendline, sellers have the upper hand and remain in control. Downside targets include last week's swing low at 0.6166 and the 200-day moving average at 0.6158.