The US jobs report is still one more day away from release. It is not often that you have to wait until the 10th day of the new calendar month to get the jobs report. The later than normal calendar release, will lead to the US CPI soon thereafter on Tuesday. The markets are keying up for those reports, as is the Fed .

Yesterday, Powell purposely said during his 2nd day of testimony yesterday, that the Fed decision later in the month (March 22) is still data dependent. That increases the jobs and inflation reports importance. However, the expectations are for jobs to show 225K for Non Farm Payroll after a 517K rise last month. The CPI ex food and energy is expected at 0.5%.

Those types of numbers should be enough to nudge the Fed back to the 50 bp hike camp once again.

To start the trading day today, the JPY is the strongest of the majors while the USD is the weakest. The JPY strength comes despite weaker GDP out of Japan which should keep the BOJ on the sidelines (weaken the JPY?). Technically, however, the USDJPY moved below a cluster of MAs in the European morning session (higher JPY) including the 100 day MA, and the 100 and 200 hour MAs. All those levels comes between 136.286 and 136.47 (see chart below). That area is now close risk. Stay below is more bearish today.

Meanwhile the 200 day MA was not left out from importance from a technical perspective for traders today. That 200 day MA put a lid on the day's trading range in the early hours of the new trading day up near 137.44, and gave the sellers the go-ahead to push to the downside. The pair's move below a swing area between 136.91 and 137.095 also supported sellers.

US stocks are lower in pre-market trading. The US yields are mixed with the shorter end marginally lower and the longer end higher. Later at 1 PM the US treasury auction off 30 year bonds. Yesterday the 10 year note auction was met with tepid demand.

At 8:30 AM, the weekly jobless claims will be released with expectations of 195K. That would represent the eighth straight week below the 200 K level.

Silvergate capital so that it will wind down operations and return cash to depositors. Silvergate is a key provider of banking services to crypto exchanges. Their services represents the plumbing for many exchanges and facilitating money exchanged between crypto and fiat currencies is now up in the air for these companies.

A snapshot of the market currently shows:

- spot gold is trading up $3.34 or 0.18% at $1816.93.

- Spot silver is trading up six cents or 0.31% at $20.07.

- WTI crude oil is trading up nine cents at $76.74

- Bitcoin is trading at $21,608. The low price reach $21,534. The high prices at $21,798.

In will premarket for US stocks, the major indices are lower after yesterday's mixed results. The declines are led by the NASDAQ index in premarket trading

- Dow Industrial Average is down -30.40 points after yesterday's -58.06 point fall.

- S&P index is trading down -13.50 points after yesterday's 5.64 point rise.

- NASDAQ index is trading down -70 points after yesterday's 45.67 point rise

in the European equity markets, the major indices are also trading lower:

- German DAX -0.44%

- Frances CAC -0.45%

- UK's FTSE 100 -0.70%

- Spain's Ibex -0.68%

- Italy's FTSE MIB -0.90%

in the Asia-Pacific markets today,:

- Japan's Nikkei 225 rose 0.63%

- Hong Kong's Hang Seng index fell -0.63%

- China's Shanghai composite index fell -0.22%

- Australia's S&P/ASX index rose 0.05%

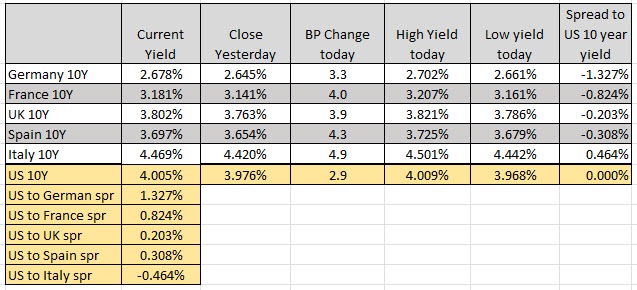

in the US at that market, the two year yield is down marginally (but still above 5%) while the 10 year yield is higher and back above the 4% level:

- 2 year yield 5.049% -1.6 basis points

- 5 year yield 4.341% +0.6 basis points

- 10 year 4.005 percent +3.1 basis points

- 30 year 3.920% +4.4 basis points

In the European debt market, the benchmark 10 year yields are also trading higher