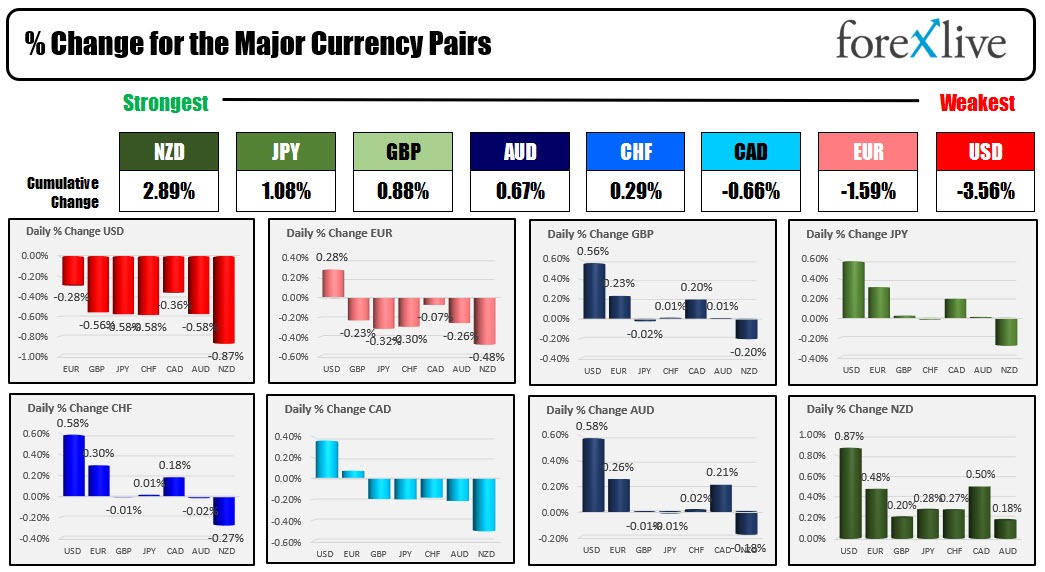

The NZD is the strongest of the major currencies while the USD is the weakest as the NA session begins. The NZD is back higher as the markets prepare for the RBNZ rate decision to take place in the new trading day tomorrow (8 PM ET). The expectations are for a 75 basis point hike. Yesterday, the NZDUSD fell below the 100 hour MA but stalled just ahead of the 200 hour MA. Today, the price has moved back above the 100 hour MA at 0.61338 (up 0.87% and the strongest of the major currency pairs). It currently trades at 0.6148.

The USD was the strongest currency yesterday, but has reversed lower in trading today and is the weakest to start the US session. The GBPUSD has seen the price move back above its 100 hour MA after falling back below the MA yesterday. The pair had been moving above and below that moving average over the last 4 trading days as traders consolidate the gains seen in November. The 200 hour MA below at 1.1809 currently has not been breached since November 10 (key level to get below if the sellers are to take control). The 100 hour MA is at 1.1863 (the current price is at 1.1888).

The USDJPY is back lower today and tests the 100 day MA at 141.079. That level will be a key barometer in the new trading day for that par.

The USDCHF is moving lower today with the dollars decline and looks toward the converged 100 and 200 hour MAs at 0.9520. The price low today reached 0.95307 in the current hourly bar. Key support at the converged MA levels in the new trading day.

Today Canada retail sales and new home price indices will be released with retail sales expected to fall -0.5%. At the last release, the preliminary indication from StatCan was also centered at -0.5%.

Feds Mester said that it made sense to slow the pace of hikes now but that the Fed is no where near finishing the tightening cycle saying that we are currently barely in restrictive territory. Fed's Daly did say that it is too early to say what she would do in December, but sees the Fed funds rate topping out in the 4.75% to 5.25% area. Today, Feds Bullard will be speaking after citing a terminal rate of 5% to 7% last week. Fed's Esther George will also be speaking.

In the ECB, Holzman endorsed a 75 BP hike in December, while ECBs Lane said yesterday that the platform for considering 75 basis point hike is no longer there.

US stocks are modestly higher after yesterday's decline. The US yields are lower today. Bitcoin is down marginally after the late day tumble on the Genesis news that they may need to file for bankruptcy as a result of the FTX aftershocks. That took the price of bitcoin to a low of $15479 (a new cycle low and lowest level since November 11, 2020). The price is off that level but still below $16000.

In other markets:

- Spot gold is trading up $8.52 or 0.49% at $1746.20.

- Spot silver is up $0.37 or 1.8% at $21.21..

- Crude oil is trading at $80.19 after settling an up and down day and $79.73 yesterday on rumors of OPEC production increases that were later denied.

- The price bitcoin is currently trading at $15,780. The low price today reached $15,613. The high price stay below the 16,000 level at $15,932

In the premarket for US stocks the major indices are higher after yesterdays declines: –

- Dow industrial average up 72 points after yesterdays -45.41 point decline

- S&P index up 9 points after yesterdays -13.3 point decline

- NASDAQ index up 15 points after yesterdays -121.55 point decline

- The Russell 2000 fell -10.59 points yesterday

The major indices are higher today in the European equity markets:

- German DAX, +0.1%

- France's CAC unchanged

- UK +0.6%

- Spain's Ibex +1.25%

- Italy's FTSE MIB +0.6%

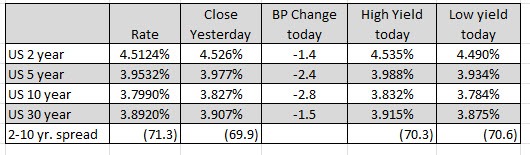

In the US debt market, yields are lower:

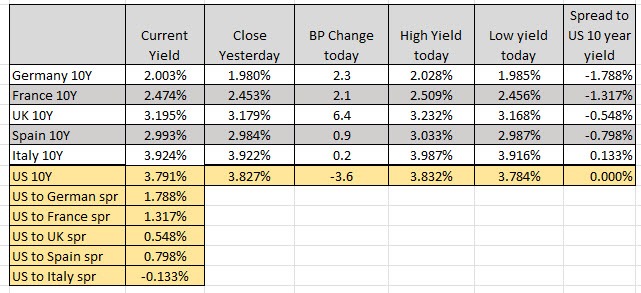

In the European debt market the benchmark 10 year yields are lower: