The USDJPY has moved higher in trading today as traders worry less about the expected new BOJ Governor Kazuo Ueda's likely policy tilt. The view is he will maintain the ultra loose policy of his predecessor Kuroda.

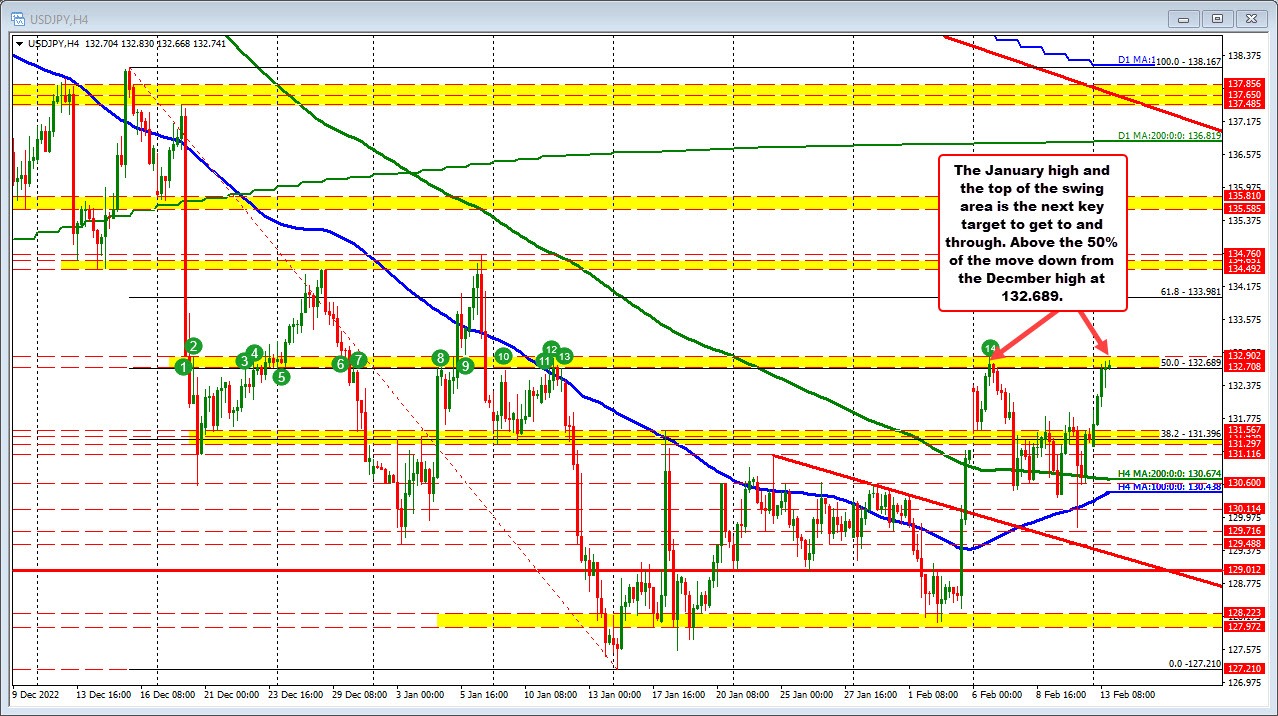

Looking at the 4 hour chart above, the price has extended up toward the swing area between 132.708 and 132.902. The 50% midpoint of the move down from the December 2022 high is also just below that level at 132.689. The high price has reached 132.83 so far. The current price is at 132.71.

Sellers are trying to keep a lid on the pair. Risk can of course be defined and limited against the area. That is a benefit to outright sellers and profit takers who want to lighten up after a nice run to start the trading week. The range today is 156 pips. The average over the last month is not much more at 169 pips. There are reasons to sell.

Having said that, a move above would increase the bullish bias more and have traders looking for more upside momentum (stay above is key).

Drilling to the 5 minute chart, the pair has been trending higher, and apart from a tiny dip below the rising 100 bar MA (blue line in the chart below), that moving average has led the way higher. For traders wanting to stay long, much of the 100 bar moving average (currently at 132.455) as a potential short-term barometer. Stay above is more bullish, but moved below and we could see further corrective price action.