- Chatter of an OPEC+ oil supply increase won't go away

- Major US indices close higher. Gains led by the Nasdaq and the S&P indices.

- Lower yields starting to feed stocks...more

- WTI crude oil futures settle at $80.95

- Fed's George: US house prices remain above pre-pandemic trend

- A US rail strike clock is ticking down. Dec 9th is a proposed strike date for rail workers

- US treasury auctions off 35 billion of 7 year notes at a high yield of 3.890%

- More from BOC Rogers: Crypto has not proven itself to be a stable store of value

- Bank of Canada's Rogers: Higher rates are starting to work to slow the economy/inflation

- WSJ: Western allies set to agree on Russian oil price cap at around $60/BBL

- European indices closing higher. German Dax approaches 100 week MA.

- Fed's Mester: Inflation expectations remain anchored

- NZDUSD back near 100 hour MA as traders prepare for RBNZ rate hike

- Richmond Fed November manufacturing index -9 vs. -9 estimate

- Eurozone November consumer confidence -23.9 vs. -26.0 estimate

- ECB's Simkus: 50 basis point and 75 basis point hikes are both possible in December

- The Morning Forex Technical report for November 22, 2022

- US energy Hockstein: Oil prices are bit higher than they should be

- Canada October new housing price index -0.2% vs -0.1% prior

- Canada September retail sales -0.5% vs -0.5% expected

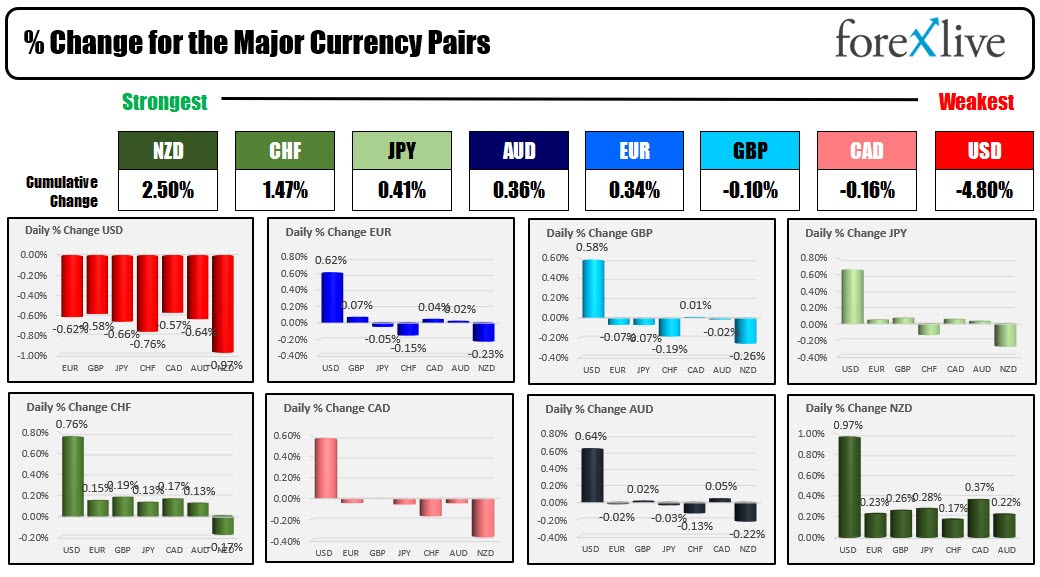

- The USD is the weakest and the NZD is the strongest as the NA session begins.

- ForexLive European FX news wrap: Dollar slightly lower amid steady markets

The US session and the trading day is ending with the:

- US stocks higher

- US yields lower

- US dollar lower.

That combination led to gold higher. Oil higher.

The markets were in synch as trading ticks down to the Thanksgiving day holiday on Thursday. For your guide, the US bond and stock markets will be closed on Thursday. On Friday, the stocks in the US will close at 1 PM as will futures pits in Chicago. Debt markets will also close early on Friday.

You can expect normal coverage at Forexlive on Thurday during our Asian and London session but the US session will die down as the markets die down in Europe. Friday will be more normal with posting winding up with the stock market close on Friday.

Looking at the US stock market, the major indices all closed higher with the Nasdaq index going from the worst to the best (or tied for the best) helped by the declining yields and risk on shift. The final numbers are showing:

- Dow up 1.18%

- S&P up 1.36%

- Nasdaq up 1.36%

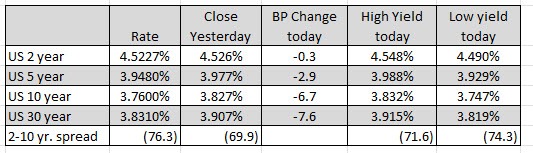

In the US debt market, the yield curve continued to invert with the 2-10 year spread moving to -76 basis points near the close. That is the most inverted going back to 1988 at the least (as far as my data goes).

In other markets:

- Gold is up $3 at $1740.89

- Silver is up $0.24 or 1.17% at $21.06

- Oil is trading at $81.22

- Bitcoin is back above $16000 at $16126.

In the forex, the NZD is the strongest ahead of their RBNZ rate decision at 8 PM ET, where the central bank is expected to hike rates by 75 basis points. The USD is the weakest, with declines of -0.57% to -0.92% vs the major currencies.