Trump's win and May's disaster stand out

The latest era in trading has undoubtedly been more about politics than anything in years. There was a time when you could safely brush aside almost any political headline but that changed with the rise of populism with free trade no longer a given.

Two elections stand out, the first is Theresa May's decision to call a snap election for June 8, 2017. It was an opportunistic effort to win a larger majority, strengthening her hand in Brexit negotiations and quieting her critics. Beforehand she had ruled out a vote and electors punished her for changing her mind.

Pollsters showed her with a 21-point lead a month away from the vote but it dwindled down to 42.4%-40.0% on election night, a net loss of 13 seats and only remaining in power because of a deal with the DUP.

The first sign of trouble was an exit poll that showed how badly Conservatives might do. That sent cable down to 1.2750 from 1.2900.

From there, it was all about reporting the results and it was clear from the first place to announce -- Newcastle upon Tyne Central -- that the Conservatives were in trouble. It got worse from there and cable fell to 1.2636 and a short time later hit 1.2600. For a brief time, Corbyn was the betting favourite to be Prime Minister but a collapse in the SNP helped to save May, at least for now.

The even bigger event was Trump's win.

The 2016 US election was likely the most-written-about vote of all time and certainly the most-polled vote of all time and yet it still managed to surprise everyone. It was the instant dawn of a new era in politics.

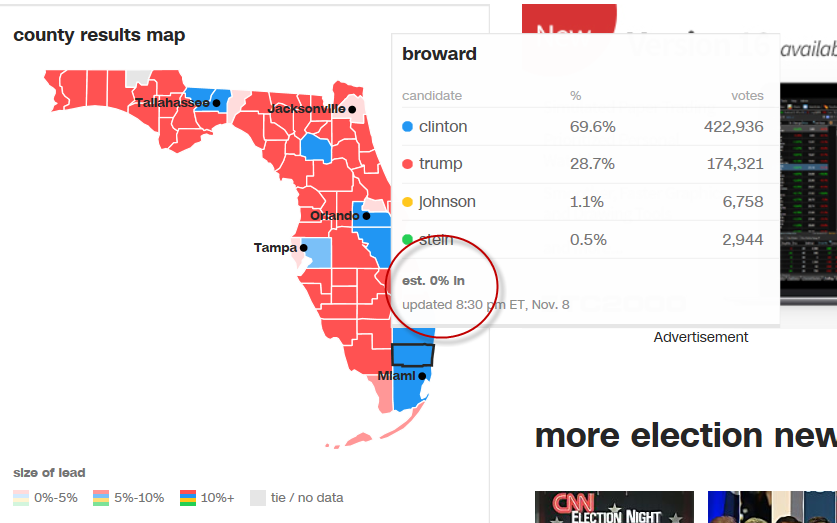

The story if you were trading it was Florida. Clinton was initially ahead but if you were watching closely, there were two things: 1) Miami-Dade (heavily Clinton) wasn't showing. 2) The panhandle (heavily Trump) wasn't in yet.

Here's what it looked like on our site.

That was a huge headfake. It turned out there was some kind of glitch in the reporting and even through the Miami area wasn't showing at a county-level, it was in the state-wide numbers. I picked up on this pretty quickly but the market was still complacent.

At that point, it didn't mean Trump was going to win, but it was going to be close. Once Virginia went to Trump, it was clear which way the wind was blowing.

It was a shock and markets were absolutely stunned as markets were sinking, I was starting to come to a different view and at 2 am, here's what I wrote:

For eight years Republicans have been ranting about fiscal discipline. In eight weeks that will all go out the window as they take over the US government.

There is global trend towards higher deficit spending and with US 10-year yields at 1.73%, it's a cheap time to borrow and spend. I see a future of unbelievable deficits as they cut taxes, spend more and try to make America great again.

It might not be worth all the expense but it will work and after the dust settles and everyone calms down, US growth is going to strengthen.

Naturally, the timing is everything and I don't see any rush to buy the dollar, probably not this month at the very least.

That's proof that you can be right and still miss the trade because the timing was wrong.

The market reaction to the US election is a remarkable learning event

I'll have my favourite memory tomorrow.